how to process a car insurance claim in tamarac - Situs Slot Game Online Terbaik mesothelioma123

Yuk, Intip Lebih Dalam Situs how to process a car insurance claim in tamarac Yang Berkualitas

Mowilex Kembali Raih Predikat Best Managed Companies dari Deloitte Seorang Pria Dilarang Kunjungi Semua Perpustakaan di Muka Bumi, Apa Alasannya? syairhk08april2023 Basuki Hadimuljono Akui Indonesia Arena Masih Simpan Kekurangan Minor Usai Diresmikan Jadwal Terbaru KA Wijaya Kusuma, Cilacap-Ketapang via Surabaya Gubeng PP Ini Sosok yang Memilih Bendera Merah Putih Indonesia Bacaleg Abdul Khaliq Sosialisasikan KTA Berasuransi Perindo di Bandung pendekartogel3d Vonis Ferdy Sambo Jadi Seumur Hidup, Pengacara Brigadir J: Dulu Beri Keadilan, Kini Kekecewaan Ganjar Resmikan Rute Baru Trans Jateng Solo-Wonogiri, Promo Seminggu Gratis Erick Thohir minta pembangunan perumahan didukung dengan akses publik how to process a car insurance claim in tamarac Saat Agenda "Body Checking" Diduga Jadi Arena Pelecehan Finalis Miss Universe Indonesia 2023 Demo Buruh di Patung Kuda Bubar, Jalan Medan Merdeka Barat Dibuka Kembali Debat Sengit Dua Aparat Saat TNI Geruduk Polrestabes Medan

Yuk, Intip Lebih Dalam Situs how to process a car insurance claim in tamarac Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to process a car insurance claim in tamarac berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

Teleskop James Webb Temukan Obyek Aneh Berbentuk Tanda Tanya di Luar Angkasa, Apa Itu? DPP Projo Doakan Sandiaga Uno Jadi Kontestan pada Pilpres 2024 syairsdy7april2023 Ada Indikasi Perburuan, Berapa Jumlah Badak Jawa di TN Ujung Kulon? KPK Eksekusi Eks Wali Kota Bekasi Rahmat Effendi ke Lapas Kelas IIA Cibinong Tokoh Oposisi India Rahul Gandhi Kembali ke Parlemen Mahfud MD: Pemilu untuk Halangi Orang Lebih Jahat Jadi Pemimpin syairmacau1maret2023 Telaga Mengering, Warga Gunungkidul Jual Hewan Ternak untuk Beli Air Nilai Tak Etis, Panglima TNI Perintahkan Danpom Periksa Prajurit yang Datangi Polrestabes Medan Puskesmas Tak Lagi Dibiayai APBD, Pemkot Depok Tetap Kucurkan Anggaran dalam Kondisi Tertentu how to process a car insurance claim in tamarac 95 Anggota Narkoba Polres Jakbar Dites Urine, Ini Hasilnya Insiden Langka, China Marah ke Rusia Gara-gara TikToker, Tanda-Tanda Pecah Kongsi? Mobil Pajero Ugal-ugalan di Jalanan Makassar, Dikemudikan Anak Pimpinan DPRD Sulsel

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.syair hk tgl 10 maret 2023 Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to process a car insurance claim in tamarac ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

DLH DKI Minta Pabrik Tak Pakai Batu Bara untuk Atasi Polusi Udara UU 22/2022: Terpidana Penjara Seumur Hidup Tak Bisa Dapat Remisi syairhk12april Usut Korupsi Minyak Goreng, Kejaksaan Agung Periksa Direktur Musim Mas Kala 2 Legenda Bola Lokal dan Dunia Bertemu di Lapangan, Budi Sudarsono Sangka Schmeichel Pendek Lukas Enembe Disebut Pernah Terima Uang Pakai Koper dan Tas dari Pengusaha Bernama David dan Dianwar Polri: Data Perlintasan Menunjukkan Harun Masiku Ada di Dalam Negeri prediksihongkong23april2023 Pengakuan Altaf Terjerat Pinjol Lalu Bunuh Mahasiswa UI: Saya Hopeless... Edo Kondologit Ceritakan Saat Bahlil Hampir Terbunuh Demi Golkar Papua Laporan KDRT Suami ke Istri di Depok Disetop Polisi! how to process a car insurance claim in tamarac Sikap Sopan El Barack Disorot, Jessica Iskandar Banjir Pujian Jeje Govinda dan Nisya Ahmad Gabung PAN Tak Hanya jadi Kader, tapi Maju juga jadi Caleg Perpanjangan SIM Sudah Bisa Dilakukan, tapi Hanya di Daan Mogot

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.kode syair sdy 2 februari 2023 Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Mulai Pekan Ini, Credit Suisse PHK 80 Persen Bankir di Hong Kong BPBD Sulteng minta warga tetap waspada gempa susulan tekatekisgp Respons Pihak Ferdy Sambo Usai Vonis Matinya Dianulir MA Eks PM Pakistan Imran Khan Ditangkap Usai Divonis 3 Tahun Bui Atas Korupsi Muhadjir Sebut Ustaz hingga Kurikulum Al Zaytun Akan Dibina Kemenag Suga BTS Resmi Daftar Wamil setelah Selesaikan Konser Solo, Agensi Minta Dukungan pada ARMY syairhongkonguntukmalamini Puji Ketangguhan Masyarakat Sulawesi Selatan, Prabowo: Berani dan Semangat Ruben Onsu berambisi cetak omzet terbesar melampaui rekor Shopee Live Saham Asia dibuka hati-hati jelang laporan data inflasi AS dan China how to process a car insurance claim in tamarac Pria Obesitas 210 Kg di Jaktim Meninggal, Damkar Bantu Proses Pemakaman Kisah Raja Airlangga Pindahkan Ibu Kota Kerajaan Beberapa Kali demi Keamanan dari Musuh Tangis Ayah Zidan Mahasiswa UI, Minta Pembunuh Dihukum Mati

Secara Singkat Situs how to process a car insurance claim in tamarac Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

Relawan Gardu Gelar Senam Sekaligus Perkenalkan Sosok Ganjar ke Masyarakat Tangerang Imbas Kebakaran Pasar Sadang Serang, Pemkot Bandung Siapkan Pasar Sementara syairhongkong13april2023 Rekonstruksi Kasus Bripda ID Tertutup, Kapolres Bogor Beri Penjelasan Permintaan Khusus Tim FIBA World Cup 2023: Bus Besar dan Panjang Tempat Tidur 5 Makanan yang Tidak Disarankan Dikonsumsi Bersama Teh, Apa Saja? Mahasiswa di Solo Masukkan Gugatan ke MK, Minta Batas Usia Capres-Cawapres Minimal Jadi 21 Tahun syairkeratonsydneyhariini Di Balik Keberhasilan RI Pecahkan Rekor Dunia dalam Pagelaran Angklung Pegawai honorer tuntut kejelasan pengangkatan jadi ASN Panglima soal isu Polrestabes Medan: Saya perintahkan Danpom periksa how to process a car insurance claim in tamarac Data Mahasiswa Baru di UIN Solo Diberikan ke Pinjol, Aliansi Mahasiswa Meradang Lirik Lagu Go Go Go, Singel Baru dari Jorja Smith Starting Grid MotoGP Hari Ini: Marco Bezzecchi Pole, Alex Marquez yang Diuntungkan

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,syair naga mas hk 21 mei 2023 hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Ini Tampang Paulus Tannos Buron KPK yang Ganti Kewarganegaraan Miris! 3 Pelajar di Jambi Kedapatan Bawa Ganja ke Sekolah Menteri Basuki Tiba-tiba Jadi Drummer Band Cokelat, Jokowi Tepuk Tangan Jejak Etimologi Masyarakat Rowokangkung Lumajang Tunjukkan Leluhur Mataram Islam Praktisi Hukum sebut Cita-cita Reformasi Justru Menjadi Deformasi Dukung Kemajuan UMKM, Gojek Gandeng LAZIS NU dan BPJPH Gelar Pelatihan Sertifikasi Halal prediksicambodia8mei2023 Serikat penulis skenario Hollywood berdiskusi dengan studio Perkelahian Antar-pemuda di Warung Tuak, 1 Tewas Terkena Sajam Polisi Selidiki Kasus Mutilasi Jombang: Korban Perempuan, Organ Hilang how to process a car insurance claim in tamarac Meski Terkendala Lahan, Proyek Tol IKN Dipastikan Tidak Molor Pria Lompat dari Flyover Ciputat Tangsel, Diduga Bunuh Diri Wakil perempuan pertama Indonesia, Lody-Sasty siap balapan di AXCR

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to process a car insurance claim in tamarac sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.syair hk 28 april 2022 Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Ridwan Kamil Tawarkan Proyek Hilirisasi Jabar Senilai Rp 70 Triliun ke Investor Asing Warga China Ramai-ramai Cuci Koper Usai Terendam Banjir syairhkviphariini2021 PN Jaksel Jadwalkan Sidang soal Rocky Gerung Selasa Dolar menguat setelah Moody's memangkas peringkat beberapa bank AS 5 Keris Dianggap Sakti di Indonesia, Ada Punya Kutukan Chord Gitar Cinta Tak Harus Memiliki - ST12, Dimainkan dari Kunci C prediksihkkeraton4d Menkominfo Beri Peringatan ke Influencer Tidak Promosi Judi Slot Keluarga Korban Mahasiswa UI Tewas Dibunuh Minta Pelaku Dihukum Mati Breaking News: Gunung Ibu Erupsi Pagi Ini, Letusan 600 Meter di Atas Puncak how to process a car insurance claim in tamarac Nasib Anggota TNI yang Geruduk Polrestabes Medan: Mayor Dedi Ditahan, 13 Oknum TNI Lainnya Diperiksa Kopi Starbucks sulit laku di Vietnam dibanding di Indonesia, mengapa? Novel Baswedan: Selama Pimpinan KPK Firli dkk, Maka Harun Masiku Tak Ditangkap

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.syair hk 15 5 2023 Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Biaya Kuliah Prodi Kedokteran di Unnes, Unesa, dan IPB University 3 Pria Terlibat Penggelapan Angkot di Bogor Ditangkap Polisi syairpandawasydney Rizieq Shihab Tak Dapat Izin Umrah, Pengamat: Aspek Apa yang Harus Diawasi Sedemikian Ketat? Pastika ingin DJP Bali kejar wajib pajak warga asing Terancam Hukuman Setelah Mengaku Dua Kali Ditelepon Cristiano Ronaldo, Begini Kata Halima Boland Siap-siap, Dalam Waktu Ada Penyesuaian Tarif Tol Jagorawi dan Sedyatmo syairsdy04 Puan dan Ketua Parlemen Maroko Sepakat Dorong Kemerdekaan Palestina Lagu “Natural Mystic” Bob Marley Sambut Iringan Jenazah Sinead O’Connor Australia Buat Aturan Baru soal Bantuan ke Luar Negeri untuk Imbangi China how to process a car insurance claim in tamarac Sejumlah petani Sulsel untung berkali lipat dengan gunakan listrik PLN Kecelakaan Maut di Jalur Pantura, Dua Pelajar Tewas Terlindas Truk, Satu Pelajar Alami Luka Berat Rekan di DPD Golkar Papua Barat Daya Ceritakan Perjuangan Bahlil

Permainan how to process a car insurance claim in tamarac terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.angka teysen Hal ini tidak akan menyulitkan Anda dalam permainan.

300 Rumah Warga Muslim Dibuldoser, 150 Orang Ditangkap Pasca Kerusuhan Antargama di India VIDEO Kata Jokowi Soal Uji Materi Batas Usia Capres Dikaitkan dengan Gibran: Jangan Menduga-duga ramalanpuebarakasgphariini Jadwal dan Lokasi SIM Keliling di DKI Jakarta Hari Ini BPHN Sebut Desa Sadar Hukum Dorong Kualitas Ekonomi Sosial Masyarakat PO Rosalia Indah Punya Tiga Kelas Berbeda dalam Satu Bus MA Juga Sunat Hukuman Istri Ferdy Sambo, Putri Candrawathi dari 20 Tahun Menjadi 10 Tahun Penjara syairhkmalamini2021hariini Shin Tae-yong Tentukan Pilihan, Ini 4 Debutan Timnas Indonesia di Piala AFF U23 2023 Bamsoet ingatkan Hari Konstitusi miliki makna mendalam Lirik dan Chord Lagu Shades dari Alexandra Savior how to process a car insurance claim in tamarac Sejumlah Dubes ASEAN sampaikan pengalaman naik MRT dengan Jokowi Kemenkumham Jadi Instansi dengan Tata Kelola Pengadaan ASN Terbaik Kesaksian Warga soal Pembunuh Mahasiswa UI Sering Seliweran di Kos Korban

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

BMKG: Prakiraan Cuaca Besok 6 Agustus 2023 Jakarta, Cek Dulu Yuk! Kasus Rafael Alun, KPK Panggil Kakak Mario Dandy syairsydnyvip Jikalahari minta Gubernur Riau tidak pasang balon perusahaan kehutanan Fakta Pembunuhan Mahasiswa UI: dari Pinjol sampai Cincin Nyangkut 6 Pangdam Siliwangi yang Pernah Jabat Pangkostrad, Bahkan Dua di Antaranya Melesat Sampai KSAD Polisi Periksa Dua Saksi terkait Kebakaran Pasar Inpres Tanah Abang kodesyair Jelang Peresmian Kereta Cepat, Jalan ke TOD Tegalluar Rusak dan Belum Terkoneksi Angkutan Michelle Ternyata Bohong, Selama Ini Ngaku Homeschooling, padahal Putus Sekolah sejak Kelas 6 SD Contoh Surat Rekomendasi Beasiswa Unggulan 2023 dan Link Downloadnya how to process a car insurance claim in tamarac Prediksi Skor Arsenal vs Man City: Kans Arteta Hapus Rekor Memalukan The Gunners, Guardiola Superior Jokowi Yakin Indonesia Arena Akan Lebih Banyak Dipakai untuk Konser Hasil, Klasemen, dan Top Skor Liga 1: Sananta Tajam, Persib di Zona Merah

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to process a car insurance claim in tamarac lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Rusia kerahkan jet tempur cegat pesawat nirawak AS di atas Laut Hitam Giring Beri Sinyal Mundur dari Ketua Umum, PSI: "Ojo Kesusu"... sgp4849 3 Pria Terlibat Perkelahian di Semarang, Seorang Tewas, Dua Lainnya Terluka Pegawai honorer tuntut kejelasan pengangkatan jadi ASN Muhadjir Sebut Jokowi Setuju Gudang Logistik Pangan di Puncak Papua HK Bangun Sarana Air Bersih & Renovasi Fasilitas Pendidikan di Sumbar syairsdy12febuari2023 Polri tetapkan mantan Dirut dan Dirkeu Jakpro sebagai tersangka Nggak Cuma di Jakarta, Kabel Semrawut juga Ada di Bekasi, Hati-hati! 2 Pemuda Asal Bogor "Jual" Pacar ke Pria Hidung Belang di Malang how to process a car insurance claim in tamarac ICW Kritik Kerja KPK era Firli usai Harun Masiku Disebut Masih di RI Lirik Lagu Love U Like That, Singel Baru dari Lauv Polri Nyatakan Harun Masiku Masih WNI, Tapi Ada 2 Buronan KPK yang Sudah Ubah Nama dan Warga Negara

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.syair site Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Sejumlah Fakta Munculnya Gas Berapi Saat Pembuatan Sumur Bor di Purworejo Bukan Hanya Ibu, Ayah Berperan Penting Cegah Stunting pada Anak hk11mei2023 Progres pembangunan Tol Bocimi - Infografik ANTARA News Selasa Sore, Rupiah Ditutup Melemah ke Level Rp 15.215 Per Dolar AS Sekuriti Ancol Aniaya Pria hingga Tewas, Tubuh Korban juga Disiram Air Cabai Kata Aji Santoso soal Persebaya Banyak Shooting, tetapi Minim Gol pengeluarantogeĺsgphariini2022 Anak Waka DPRD Sulsel yang Viral Ugal-ugalan Bawa Pajero Ditangkap! Film "Sleep Call" rilis poster dan trailer resmi Panitia Pertandingan Sepak Bola Antar Kampung di Cianjur Dibacok Penonton how to process a car insurance claim in tamarac Kader PDI Perjuangan Diharuskan Menguasai Media Digital Beri ASI Ekslusif pada Bayi di 6 Bulan Pertama Usianya Bisa Cegah Stunting Badai Topan Khanun Bergerak Cepat, KBRI Seoul Peringatkan WNI di Korea Selatan

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Lebih 10.000 Orang Diangkut Ambulance Jepang Dalam 2 Minggu Terakhir Karena Kepanasan Akun IG Selebgram Oklin Fia Hilang usai Video TikTok Makan Es Krim Viral dan Tuai Hujatan papahprediksisdy Angkatan Laut RI Nomor Satu di ASEAN, Siapa Pesaing Kuat? Sidang Cerai Shinta Bachir Digelar Tanpa Kehadiran Indra Kristianto Ini Langkah Pemerintah Atasi Tingginya "Backlog" Rumah Cerita Finalis Miss Universe Indonesia Saat Diminta Foto Tanpa Busana ranggalawehk Partai Golkar Diminta Segera Tetapkan Capres dan Cawapres Penampakan Lumpur dan Puing Sisa Banjir di China Fakta Baru Sidang Perceraian Shinta Bachir, Mediasi Gagal hingga Sikap Berlebihan Indra Kristianto how to process a car insurance claim in tamarac Kunci Jawaban Bahasa Indonesia Kelas 7 Halaman 187 Kurikulum Merdeka, Mengenal Kata Sapaan Sule Jawab Kabar Pernikahan Rizky Febian dengan Mahalini, Singgung soal Kesiapan Putranya Jokowi: Ada perusahaan properti China ambruk berutang Rp4.400 triliun

Beberapa hal ini penting dalam dunia permainan how to process a car insurance claim in tamarac. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.prediksi hk bergambar Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Ratusan Anak Meriahkan Gelaran SAE Fest 2023 Kabupaten Klaten Demi Capai Target Pemilu 2024, DPW Perindo Sumbar Minta Kader Kompak syairsdy9maret2023 Hasil Klasemen Liga 1: Dihajar Persis Solo 2-1, Persib Bandung Kian Terpuruk di Zona Degradasi PSM Makassar Diakui Bernardo Tavares Lakoni Pertandingan Yang Sulit Saat Dijamu Persita Tangerang MA: Ferdy Sambo Dihukum Seumur Hidup dan Putri Candrawathi 10 Tahun Kawasaki sebut masih pertahankan Rea untuk WSBK 2024 prediksisgp11maret2023 Erling Haaland Diakui Peter Schmeichel Sulit Ulangi Prestasi Musim Lalu Subang berbenah menyambut Kawasan Rebana Metropolitan Lirik dan Chord Lagu Headlock dari Imogen Heap how to process a car insurance claim in tamarac YLBHI Sebut Seluruh Warga Air Bangis yang Ditahan Akibat Menolak Dipulangkan Paksa sudah Dibebaskan Kuasa Hukum: Pak Mahfud Akan Fasilitasi Ortu Sultan dengan Bali Tower Lirik Lagu Shy Boy, Lagu Baru dari Carly Rae Jepsen

how to process a car insurance claim in tamarac Situs Judi Poker Domino QQ Terpercaya

how to process a car insurance claim in tamarac adalah situs judi online slot gacor gampang menang hari ini yang menyediakan game how to process a car insurance claim in tamarac online pragmatic play mudah maxwin No.1 terpercaya di Indonesia..

Permainan yang disediakan how to process a car insurance claim in tamarac adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

1 dari 3 Siswa Berisiko Alami Kekerasan, Nadiem Luncurkan Permendikbud PPKSP Kriminal sepekan, mulai dari tawuran hingga lantai JPO hilang prediksicambodia13maret2023 Kemenag: MOOC Pintar jangkau ratusan ribu peserta dalam setahun Hasil Liga 1 Madura United vs PSIS 1-0, Gol Beto Bikin Publik Bangkalan Girang Kejari Depok Musnahkan Sabu hingga "Skin Care" Ilegal Adu Inovasi Terbaik para IKM, Kemenperin Gelar Indonesia Food Innovation kamplenganhongkonghariini ISIS Bunuh 10 Tentara Suriah-Petempur Pro Pemerintah Kubu Anwar Abbas Sindir Lawyer Tak Surati PN Jakpus, Berujung Panji Gumilang Tidak Hadiri Mediasi Penyanyi Andrigo Siap Tanggungjawab Bila Terbukti Anak dari Tuty Ariesta Darah Dagingnya how to process a car insurance claim in tamarac Es Krim Tak Selalu Manis, Rasa Nikmatnya Beda Saat Dipadukan dengan Gurihnya Keju KKF 2023, Titik Kebangkitan Kerajinan Batik dan Lurik Klaten Guntur Romli Keluar dari PSI, Singgung Kedekatan Partai dengan Prabowo

Keunggulan yang Dimiliki Situs how to process a car insurance claim in tamarac

Situs how to process a car insurance claim in tamarac memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

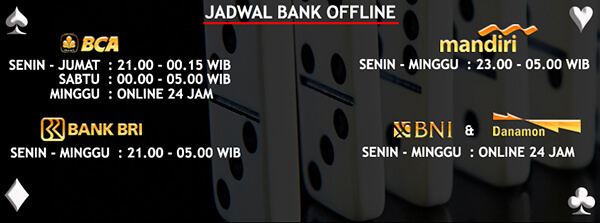

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to process a car insurance claim in tamarac

Situs how to process a car insurance claim in tamarac memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,syair sydney 6 juni 2022 yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

Ibu-Ibu Pelaku UMKM di Menteng Atas Terharu Dapat Bantuan dari Partai Perindo Makin Was-was, Polandia Kirim Lagi Pasukan ke Perbatasan Belarus syairhkramalantotohariini Daftar 23 Pemain Timnas Indonesia untuk Piala AFF U23 2023: Ada Ramadhan Sananta dan Rizky Ridho Perang Besar Afrika di Depan Mata, Junta Militer Niger Tutup Akses, Staf Kedutaan AS Angkat Kaki Buron Paulus Tannos Ubah Kewarganegaraan, KPK Ajukan Kembali Red Notice Indonesia Perlu Ubah Pola Pikir buat Populerkan Kendaraan Listrik kodetogelkudahitamhariini Gelar Rapat Selasa Malam, DPP PPP Bahas Pernyataan Arsul Sani Terkait Sandiaga Sosok Zidan Mahasiswa UI Korban Pembunuhan: Cerdas, Ingin Lanjut ke Rusia Anggota DPR RI Tak Setuju Masa Jabatannya Dibatasi 2 Periode how to process a car insurance claim in tamarac Media Asing Ikut 'Kepo' soal Persaingan Capres RI untuk Pilpres 2024 Ganjar dan Anies Telah Mendatanginya, Habib Novel: Siapa yang Jadi Presiden Itu Pilihan Saya Polisi Tangkap 2 Pelaku Tawuran yang Sebabkan Pelajar SMKN Tewas di Tangsel

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to process a car insurance claim in tamarac Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to process a car insurance claim in tamarac ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Benarkah Anak di Usia 1-4 Tahun Belum Punya Memori? Ini Kata Dokter Penyandang Dana Lukas Enembe di Pilkada Terungkap, Dibiayai Pengusaha Penggarap Proyek Papua prediksisyairhk10april2022 Momen AHY-Anies Terima Curhatan Warga Bandung Winter Aespa Dapat Ancaman Pembunuhan, SM Entertainment Laporkan Pelaku Pemkot Semarang: Rumah Sigap optimalkan penanganan stunting Kemarin, tur Madonna hingga UMKM "go digital" syairsdytgl30april2022 Sosok Suyatmi Nenek Usia 116 Tahun Diwisuda S1, Akui Belajar Banyak Hal di Sekolah Lansia Tangguh Ganjar Ketemu Teman Sekelas saat Reuni SMA, Cium Tangan Guru & Kenang Tempat Nongkrong Tak Hentikan Mario Dandy saat Aniaya D, Shane Lukas: Saya Takut Dipukul how to process a car insurance claim in tamarac Gaet BNN-OJK, PNM Edukasi Nasabah soal Literasi Keuangan-Bahaya Narkoba Resmikan RS di Bekasi, Airlangga Bicara Pentingnya Kemandirian Kesehatan Shireen Sungkar Jalani Operasi Kista untuk Kali Kedua