how to low car insurancems car insurance in savannah - Daftar 10 Situs Slot Online Terpercaya mesothelioma123

Yuk, Intip Lebih Dalam Situs how to low car insurancems car insurance in savannah Yang Berkualitas

Thailand to Drop Mask Rule, Foreign Tourist Registration Jokowi Receives Outgoing ASEAN Secretary General Lim Jock Hoi bukaansidney Indonesia Central Bank to Reduce Inflation to 3.61% in 2023 Indonesia Highlights: Indonesian Authorities to Autopsy Man Who Died After Receiving AstraZeneca’s Covid-19 Vaccine | 6.2 Richter Scale Earthquake Strikes East Java, Other Indonesian Provinces | Presi Saudi Arabia Allows Direct Entry for Indonesian Travelers, No Covid Booster Shot Needed Bali’s Premium Burger Joint Enters the Jakarta Food Scene victorytoto Indonesia Discusses Investment in New Capital City Nusantara at G20 Foreign Ministers' Meeting Salvage Operation of Indonesian Submarine Ends Indonesia Extends Covid-19 Restrictions, Allows Trial Runs for Some Tourist Attractions to Resume Operations how to low car insurancems car insurance in savannah Roger Federer Announces Retirement from Professional Tennis India Bridge Collapses, Killing at Least 130 People South Korea Police Admit Failures at Itaewon Stampede

Yuk, Intip Lebih Dalam Situs how to low car insurancems car insurance in savannah Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to low car insurancems car insurance in savannah berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

President Jokowi Orders Relief For NTT Province to Be Stepped Up 27 Deaths Not Related to Sinovac Vaccine: Indonesia Covid Task Force ibosportnexus Indonesia’s President Jokowi Criticizes Uneven Global Distribution of Covid-19 Vaccines Six People Sentenced to Death for Masterminding Riot at Indonesia’s High-Security Detention Center Indonesia Gets Tough on ‘Mafia’ Marking Up Fees for Quarantine, Visa Application Process Covid-19: Government Calls for Low-Key CNY Celebrations in Indonesia chordjandicarijuo Myanmar Junta’s Foreign Minister Not Invited to Upcoming ASEAN Meet: Cambodia Indonesia’s Islamic Finance Holds Its Ground Against Covid-19: Finance Minister Indonesian Police: JAD Militants in Merauke, Papua Made Multiple Attempts on Archbishop’s Life how to low car insurancems car insurance in savannah Philippines Court Acquits Maria Ressa of Tax Evasion The Absence of Indonesia in 2021 All England Open Singapore Court Waives Death Penalty For Indonesian Migrant Worker

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.erek36 Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to low car insurancems car insurance in savannah ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

First Indonesia's Culinary Business School Launched in West Java Excise Tax Hiked on Tobacco in Indonesia downloadminion2015subindo Foreign Companies Eye Airport Management Projects in Indonesia: Minister’s Top Aide Empowering Local Community through Gayo Coffee Harvest Festival in Indonesia’s Aceh Quake in Indonesia's East Java Kills Eight, Damages over 3,000 Homes Indonesia Highlights: Indonesia’s Lion Air Carrying Chinese Workers from Wuhan Receives Flight Approval | Indonesia’s State-Owned Firms Plan to Boost Entrepreneurship in 1,000 Islamic Boarding Schools vivanewssepakbolaindonesia 16 Million Doses of Covid-19 Bulk Vaccine from China’s Sinovac Arrive in Indonesia Six People Killed in Philippine Typhoon Indonesian Covid-19 Positive Airline Passengers Entitled to Refunds how to low car insurancems car insurance in savannah Digital Technologies Help Indonesian MSMEs Survive amid Pandemic Indonesian Maritime Forces Nab Vietnamese Squid Poaching Vessels Indonesia Task Force Urges Greater Covid-19 Vigilance at Border Crossing Points

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.togel 389 Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Coronavirus: Why EU lags behind China and Russia in ASEAN vaccine diplomacy Indonesia Highlights: Indonesia to Receive 15 Million Doses of Covid-19 Bulk Vaccine Tuesday | Indonesia Extends Ban on Foreigners to End of January | Water Park near Jakarta Closed for Flouting Covid miminazrinamp3 Indonesia Highlights: Covid-19: Indonesia to Identify More People in Contact Tracing Program | Covid-19: Government Calls for Low-Key CNY Celebrations in Indonesia | Foreign Capital Flows Could Reach Indonesia Police Detain Woman Carrying Gun Outside Presidential Palace Indonesia Reiterates Share of Responsibility to End Occupation of Palestine during NAM Meet Indonesia’s Defense Minister Prabowo Subianto is the Most Electable Party Elites: Kompas Survey statistikligachampions2023 BREAKING NEWS: Indonesia Cancels Sending Hajj Pilgrims to Saudi Arabia Indonesia to Start Vaccinating Children With the Covid-19 Vaccine Indonesia Discusses Investment in New Capital City Nusantara at G20 Foreign Ministers' Meeting how to low car insurancems car insurance in savannah Indonesia Coffee Day: Ambon’s Signature Rarobang Coffee, Anyone? Mounds Appear After Seroja Cyclone in East Nusa Tenggara Japan Thanks Indonesia for Scrapping Coal Export Ban

Secara Singkat Situs how to low car insurancems car insurance in savannah Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

Indonesia’s President to Visit Ukraine, Russia Next Week Indonesia, Vietnam Conclude EEZ Negotiations liriklagutrainwreck Indonesia Highlights: Indonesians Urged to be Patient as Covid-19 Vaccine Remains Limited | Jokowi Delivers Nyepi Day Greeting to Hindus in Indonesia | Teenage Mercedes Driver Arrested after Hitting C Proposed Tailings Dam For Indonesian Zinc Mine 'Almost Certain' to Collapse Indonesia Aims for Center of the World’s Halal Industry by 2024 Emergency Covid-19 Hospital in Jakarta Rocked by Sexual Scandal makmucomprediksi New Malaysia PM Anwar in Indonesia on First Foreign Trip China’s Association of International Economic Strategy Receives Congratulatory Messages from World Leaders Indonesian Police Uncover Bombmaking Bunker in Lampung Province how to low car insurancems car insurance in savannah G20 Foreign Ministers Meet in Bali Indonesia Highlights: Densus 88 Counterterrorist Police Nab Terror Suspects in East Java | Presidential Bodyguard Cracks Down on Motorcycles | Authorities in Bali Rearrest Russian Interpol Fugitive Indonesia to Implement Travel Bubble Scheme on Crews, Racers during MotoGP Race

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,live result tercepat nevada hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Indonesian Health Care Workers to Receive Free Staycation Program to Boost Tourism Indonesia Highlights: Indonesian JI Militants Respected by Terrorists in Syrian Civil War | Indonesia Distributes First Covid-19 Vaccines Nationwide | Indonesian Public Upbeat About 2021 Indonesian Authorities Vaccinates Clerics With the Covid-19 Vaccine At Jakarta’s Istiqlal Mosque Failure to Pay Holiday Allowance Could Result in Fines, Sanctions: Indonesian Minister Rohingya Refugee Boat Lands in Indonesia after Month at Sea Shanghai Discharges Thousands of Patients, Boosts Covid Supplies lsdgeniuslirik Indonesian JI Militants Respected by Terrorists in Syrian Civil War Locally Made GeNose Covid-19 Detector Available at Indonesia’s Airports in April Indonesia Never Intends to List Widi Islands for Sale how to low car insurancems car insurance in savannah Aung San Suu Kyi, Australian Advisor Charged in Myanmar with Official Secrets Violations At Least 129 People Dead after Riot at Indonesia Football Match BelagaOne: A Proboscis Monkey Sanctuary in North Kalimantan, Indonesia

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to low car insurancems car insurance in savannah sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.permainan angkot the game Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Indonesia Allocates 9.3 Million Covid Vaccines for Second Booster Shots Bali Can Become Location for Genomic Data Research Center: Indonesian Minister mayonakanodoorlyrics More Tourism Villages Need to Go Digital: Indonesian Minister Indonesian State Firms Expected to Pay Out 35 Trillion Rupiahs in Dividends Indonesian AstraZeneca Vaccine Recipient in Bali Dies Animals Gone Wild: Orangutan Evacuated after Entering Village in East Kalimantan, Indonesia kuy888 Government Advises Schools in Indonesia to Immediately Begin Limited Face-to-Face Learning Indonesia Highlights: Indonesia Revokes Legalization of Alcoholic Beverage-related Investments | Indonesia Gets Fifth Covid-19 Vaccine from China’s Sinovac | Jokowi Inaugurates Indonesia's Yogyakarta- Indonesian McDonald’s Outlets Sanctioned After Runaway Demand For BTS Meals how to low car insurancems car insurance in savannah Indonesia to Launch Homegrown Covid-19 Vaccine Soon Two-Headed Baby Born in Indonesia’s Sumatera Indonesia Highlights: Gov't Assistance to Mass Media Companies Continues until June | Jakarta's Governor Dissuades Traveling on Chinese New Year | Military and Police Needed to Combat Covid-19

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.nitroseen Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Four Terror Suspects Arrested in Indonesia’s Lampung Chinese Workers Denied Access to Covid-19 Vaccines in Indonesia kodesyairhk13mei2023 Indonesia Highlights: Indonesia’s Top Diplomat Urges End to the Nationalization of Covid-19 Vaccines | World Bank: The Indonesian Economy Will Take Years to Get Back to Pre-Covid-19 Levels | Man in E Asian Markets Swing as US Inflation Spikes See Rate Hike Bets Soar BREAKING NEWS: Indonesian Navy Loses Contact With One of Its Submarines Indonesian Aircraft Manufacturer Dirgantara’s N219 Plane Ready to Fly videolucubangetbikinngakakjungkirbalikpart1 President Jokowi Gives Cash to Indonesian Terror Suspect’s Wife Who Faces Financial Hardship Indonesia’s Muslim Preacher Sheikh Ali Jaber Passes Away Four Terror Suspects Arrested in Indonesia’s Batam how to low car insurancems car insurance in savannah UNESCO Assessors to Visit Meratus Geopark in Indonesia's South Kalimantan 15 Million Doses of Covid-19 Bulk Vaccine Arrive in Indonesia Indonesia Summons Britain’s Envoy over Rainbow Flag Flown Outside Embassy

Permainan how to low car insurancems car insurance in savannah terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.pengeluaran sgp 2016 sampai 2022 Hal ini tidak akan menyulitkan Anda dalam permainan.

Indonesia Wants to Continue Defense Equipment Cooperation with Japan Death Toll Nears 6 Million as Pandemic Enters Its 3rd Year slotlions88 Patients with Coronavirus Increase by 20 Percent in Jakarta’s Emergency Hospital Indonesian McDonald’s Outlets Sanctioned After Runaway Demand For BTS Meals Indonesia Highlights: Indonesia Plans to Develop Nuclear Power to Generate Electricity | Myanmar Opposition Request Representation at ASEAN Meeting in Jakarta | Indonesian Police Name Jozeph Paul Zhan Java Jazz Festival 2022 Returns in Jakarta tri7bet Sinopharm Covid-19 Vaccines Arrives in Indonesia 6.2 Richter Scale Earthquake Strikes East Java, Other Indonesian Provinces Jokowi Chooses Nusantara as Indonesia’s New Capital Name, Says Minister how to low car insurancems car insurance in savannah Afghanistan to Discuss Fate of Foreign IS Prisoners with Their Countries Six People Sentenced to Death for Masterminding Riot at Indonesia’s High-Security Detention Center Foreigners Can Get Covid-19 Jab in Jakarta

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Last Surviving Bali Bomber's Apology Rejected by Victims Number of Indonesians Under the Poverty Line Surges Due to Covid-19 ayam2dtogel Saudi Arabia Allows Direct Entry for Indonesian Travelers, No Covid Booster Shot Needed Indonesia Policeman Jailed over Football Stadium Crush Indonesia to Produce Homegrown Covid-19 Vaccines Next Year, Chief Minister Confirms China Records Largest Increase of Covid-19 Cases since Pandemic Began melayu4d Indonesia Eyeing Singapore as Electricity Export Market Indonesia Discusses Investment in New Capital City Nusantara at G20 Foreign Ministers' Meeting Jokowi Delivers Nyepi Day Greeting to Hindus in Indonesia how to low car insurancems car insurance in savannah Indonesia Finalizes Purchase of 50 Million Doses of Covid-19 Vaccine from Pfizer Indonesia’s Silver Crafts from Bantul Lure G20 Delegates Indonesia’s Vice President Seeks Increase in Hajj Quota

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to low car insurancems car insurance in savannah lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Indonesia Highlights: Gov't Assistance to Mass Media Companies Continues until June | Jakarta's Governor Dissuades Traveling on Chinese New Year | Military and Police Needed to Combat Covid-19 Indonesia Highlights: Six Dead, Several Missing after Boat Sinks in Bali Strait | Three Terror Suspects Arrested in Jakarta, Bangka Belitung | Vaccination for Children to Start in Jakarta, Says Pediat downloadvideobonekaannabelle Indonesia Reports over 6,600 Daily Covid-19 Cases Indonesia's Covid-19 Task Force Concerned As Daily Covid-19 Cases Near 9,000 Collective Prevention Needed to Fight Against Child Marriage in Indonesia Ngabuburit, An Indonesian Ramadan Tradition lirikpositions In-Person Learning Must be Held with Extra Cautious, Jokowi Tells Indonesia Targets to Provide 0 Billion for MSMEs Credit Program in 2024 Indonesia Requires 10-day Quarantine for All Arrivals over Omicron Variant how to low car insurancems car insurance in savannah Nike to End Run Club App in China Indonesian Mental Hospital Treats Hundreds of Children Who Suffer from Device Addiction President Jokowi: We Will Prove Bali Is A Safe Destination to Visit

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.download duty after school part 2 Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Foot-and-Mouth, Lumpy Skin Disease Outbreaks in Indonesia Spark 4 Million NSW Biosecurity Lift Indonesia Highlights: 81 Rohingya Refugees Stranded in Indonesia's Aceh Province | Jakarta’s Deputy Governor Takes Cautious Approach to Face-to-Face Classes | Surveillance Cameras Catch Sight of Mys purislotalternatif Jokowi Calls for Cut in Covid PCR Test Cost to Rp300K Jakarta Tightens PPKM, Extends the Policy in the Capital Indonesia Highlights: Indonesia Weighs in on Military Coup in Myanmar | Indonesia to Receive Consignment of AstraZeneca Covid-19 Vaccines | Indonesian President Bank Syariah Indonesia to Be Inclusive Indonesia Highlights: Indonesian Navy Launches First Domestically Built Submarine | Indonesian Police to Reward Netizens for Reporting Cyberspace Crimes | Indonesia’s Former VP Suggests Mosques for C liriklaguamazing Indonesia Highlights: Local Transmission of Indian Covid-19 Variant Found in Greater Jakarta Area | Indonesia to Use Homegrown 'Merah Putih' Vaccine in Covid-19 Jab Drive | 7,000 MSMEs Register for Pr UAE to Invest 0 Million in Indonesia’s Tourism, Property Sector Indonesia Highlights: AstraZeneca Denies Using Swine Trypsin in Its Covid-19 Vaccine| Mishap at Jakarta’s Halim Airport Causes Diversion of Flights to Soekarno-Hatta Airport | Indonesian Embassy in Ja how to low car insurancems car insurance in savannah Indonesia Police Urges Strict Control Policy of Arrivals at Soekarno-Hatta Airport President Jokowi Meets Elon Musk at SpaceX Facility Indonesia to Produce Homegrown Covid-19 Vaccines Next Year, Chief Minister Confirms

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Indonesia Highlights: Indonesian Migrant Workers Returning From Saudi Arabia Suspected of Carrying British Covid-19 Strain to Indonesia | 1 Policeman Dead Following Clashes with Islamic Militants in C Indonesia Highlights: Road Cyclist Dies during Trial Run of Jakarta’s Bike Lane | Indonesia, Russia to Sign MoU on Agriculture | More Tourism Villages Need to Go Digital: Indonesian Minister liriklagungamen1 Over 16 Million Beneficiaries Receive Fuel Cash Assistance in Indonesia KNKT: Auto-Throttle Malfunction Suspected in Sriwijaya Air Disaster Animals Gone Wild: Elephant Handler in Indonesia’s Aceh Province Mauled By Wild Elephant Indonesia Highlights: Indonesia Sets New One Day Record of Covid-19 Cases With 14.224 | Casualties at Majene Regency Earthquake in West Sulawesi Increases to 46 Dead, 826 Injured | South Kalimantan jadwalnewpallapa2018 Indonesia Highlights: Indonesia to Receive 15 Million Doses of Covid-19 Bulk Vaccine Tuesday | Indonesia Extends Ban on Foreigners to End of January | Water Park near Jakarta Closed for Flouting Covid It Took Four Days to Evacuate Body of Portuguese Trekker at Indonesia’s Mt Rinjani Death Toll from Indonesia Quake Rises to 321 how to low car insurancems car insurance in savannah Traditional Eid Dishes from Around the World Indonesia Scraps Steep Rise in Komodo National Park Entrance Fee Indonesia to Begin Covid-19 Vaccinations for the Elderly Next Week

Beberapa hal ini penting dalam dunia permainan how to low car insurancems car insurance in savannah. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.sugar rush game Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Excise Tax Hiked on Tobacco in Indonesia Indonesia’s Jokowi Targets Food Crisis during Russia-Ukraine Peace Mission empresskiepisode1subtitleindonesia Indonesia Extends Covid-19 Restrictions in Java, Bali Again to Aug. 23 Foreigner's Orgasm Classes Causes Stir in Bali and Rest of Indonesia Indonesia Highlights: 11 Suspected Terrorists in Merauke Linked to JAD, Makassar Cathedral Bombing | Broken Ancient Ceramics Found near Batavia Castle in Jakarta | Two Indonesian Climbers Set New Men’ Internal Dynamics of the Democratic Party in Indonesia 192.168.0.1tenda Indonesia Delays AstraZeneca Vaccination, Waiting for WHO Review Indonesia, Saudi Arabia Seek Ways to Cut Hajj Waiting Time Jaguar TCS’ Mitch Evans Emerges Champion in Jakarta E-Prix how to low car insurancems car insurance in savannah Southeast Asia’s Rocky Road to Democracy Covid-19 Pandemic Could Cost Global Tourism Trillion: UN reports Eight Private Indonesian Universities To Open On-Campus Clinics for Covid-19 Vaccine

how to low car insurancems car insurance in savannah Situs Judi Poker Domino QQ Terpercaya

how to low car insurancems car insurance in savannah slot【jaminan kredit 100%】Bonus 100% untuk setoran pertama,how to low car insurancems car insurance in savannah lebih dari ratusan permainan menyenangkan di mesin slot domino..

Permainan yang disediakan how to low car insurancems car insurance in savannah adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Indonesia Detects First Case of Monkeypox Virus Rescued Dolphins Swim Free from Indonesia Sanctuary jayatogelsyd Indonesia’s Ambassador to Ukraine Dies at 58 Indonesia Gets Covid Aid from Singapore, Australia Indonesian Navy Launches Two Warships to Meet Minimum Essential Force Up to 80 Percent of Covid Patients in Indonesia Report Mild Symptoms, No Symptoms mapan4d Indonesia Invents Detecting Tool for Covid-19 5.6-Magnitude Earthquake Shakes Indonesia’s West Java Indonesia Child Deaths Blamed on Syrup Medicines Rise to 195 how to low car insurancems car insurance in savannah Indonesia Highlights: 81 Rohingya Refugees Stranded in Indonesia's Aceh Province | Jakarta’s Deputy Governor Takes Cautious Approach to Face-to-Face Classes | Surveillance Cameras Catch Sight of Mys Belgian Man, His Indonesian Wife Brings Belgian Tastes to Yogyakarta Madeleine Albright, First Female US Secretary of State, Dies at 84

Keunggulan yang Dimiliki Situs how to low car insurancems car insurance in savannah

Situs how to low car insurancems car insurance in savannah memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

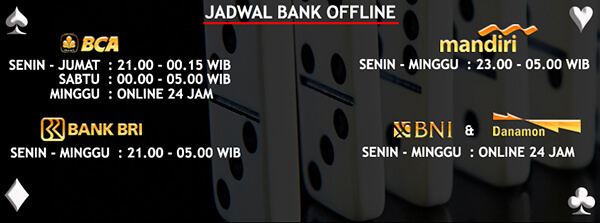

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to low car insurancems car insurance in savannah

Situs how to low car insurancems car insurance in savannah memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,data nagason yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

President Jokowi Shares Indonesia’s Covid-19 Progress With German Chancellor Merkel Indonesia to Distribute Monkeypox Vaccine by the End of 2022 livedrawquezon Indonesia's 2022 World Cup Qualifying Run Ends With 4-0 Beating by Vietnam Kalimantan Locals Attempt Feats of Voyaging to Java Covid-19 Transmission Under Control in Early December: Indonesia's Health Minister Indonesian Medical Association Urges Govt to Close Borders Temporarily Over New Covid Variants sinar4dslot China, US agree on need for stronger climate commitments Indonesia Plans to Create More Halal Industrial Zones Indonesia Highlights: Local Transmission of Indian Covid-19 Variant Found in Greater Jakarta Area | Indonesia to Use Homegrown 'Merah Putih' Vaccine in Covid-19 Jab Drive | 7,000 MSMEs Register for Pr how to low car insurancems car insurance in savannah Jakarta Applies Enforced Micro-Scale Restriction of Community Activities to June 14 Indonesia Introduces Cassava Rice in a Strategic Shift from Popular Grain Covid-19 Booster Shots Are Free to the Public, Says Jokowi

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to low car insurancems car insurance in savannah Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to low car insurancems car insurance in savannah ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Indonesia Arrests 12 Terrorist Suspects Planning Attacks Indonesia Highlights: Indonesia Will Begin Holy Muslim Fasting Month of Ramadan April 13 | Ministry of Religious Affairs: No Ramadan Gatherings in Covid-19 High Risk Zones | Papuan Regional Police prediksidapurtoto Netherlands Expected to Apologize for Slavery Indonesia House Speaker Hands Over Humanitarian Aid to Turkish Parliament China Issues ‘Red Alert’ for Typhoon Muifa, Forcing Flight and Train Cancelations German Embassy Staff Member Banned from Indonesia after FPI Visit artiliriklagunotyou Indonesia's Bromo Tourism Not Affected by Mt. Semeru's Hot Ash Clouds Second Indonesia Tiger Attack in Days, Hunt Ongoing Indonesia’s Digital Health Program Gets Support from Bill Gates how to low car insurancems car insurance in savannah WHO Appeals to China to Release More Covid-19 Information Indonesian Police Investigates Sambo as Suspect in Premeditated Murder Case Indonesia Arrests 12 Terrorist Suspects Planning Attacks