how to donate a car in hobe sound - 2025 Mudah Menang Hari Ini mesothelioma123

Yuk, Intip Lebih Dalam Situs how to donate a car in hobe sound Yang Berkualitas

Bocoran Nama The New SUV, Mitsubishi XForce Cerita Warga soal Duta Sheila on 7 Main Voli 17-an Bapak-bapak di Jogja unigoal Bertemu Presiden Jokowi di Istana, Puan Maharani Akui Bahas Pilpres Penampilan Kasar Messi Jadi Jimat Inter Miami Gertak FC Dallas, Gerardo Martino: Hati-hati Saja Michelle Nangis Menjerit di Pengadilan, Pinkan Mambo Justru Cuek karena Takut pada Keluarga Steve Keketuaan ASEAN-BAC Summit 2023 Dorong UMKM Naik Kelas pengeluaranhkdata2022 Prabowo di Mata Mantan Mentan Amran Sulaiman: Pemimpin Berkarisma dan Disegani di Dunia Petinggi PDIP Bertemu Connie Bakrie Malam Ini, Bahas Apa? FM Masruri Turut Meriahkan Kontan Chess Championship 2023 how to donate a car in hobe sound WNI 4 Bulan Koma Pascaoperasi Amandel di Polandia, Kemenlu Sebut Ada Dugaan Malpraktik Tingkatkan Pelayanan dan Daya Saing Pelabuhan, Kemenhub Gelar Rapat Teknis Inaportnet Wilayah Timur Daftar Kekayaan 5 Hakim MA yang Tangani Kasasi Ferdy Sambo dkk, Ada yang Hartanya Rp 11 Miliar

Yuk, Intip Lebih Dalam Situs how to donate a car in hobe sound Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to donate a car in hobe sound berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

Kemarin, tur Madonna hingga UMKM "go digital" Mobil Pimpinan DPRD Sulawesi Selatan Mitsubishi Pajero Sport Ugal-ugalan Pakai Strobo dan Sirene klasemena.s.romawomen Saat Belanda Dibuat Repot Aksi Mogok Pelaut Indonesia-Australia One Piece Episode 1071 Tampilkan Gear 5, Luffy dalam Wujud Dewa Matahari Nika Ema: Pengadaan CCTV Dishub Kota Bandung dibahas dalam Banggar DPRD Jeratan Pinjol Bikin Altaf Tega Tikam Dada Mahasiswa UI 10 Tusukan rekaptogelmacau Dituding Cari Dukungan PSI untuk Pilpres 2024, Begini Respons Prabowo FOTO: Horor Serangan Bom Atom Hiroshima-Nagasaki 78 Tahun Lalu Polri Sebut Ada Buronan KPK yang Sudah Ganti Kewarganegaraan how to donate a car in hobe sound Imbas El Nino, Terjadi 13 Kali Kebakaran Lahan Gambut di Kabupaten Bandung Penyidik temukan kesesuaian laporan PPTAK terkait TPPU Panji Gumilang Lapas Karang Intan usut warga binaan tewas usai duel antar penghuni

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.no kodok Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to donate a car in hobe sound ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

Sindikat APK Jebakan Peretas HP Kapolda Jateng Raup Rp 1,5 M Sebulan Diskominfo Sulbar minta maaf terkait pernyataan Penjabat Gubernur dhx4ddemo Taman Safari Bogor bayar tiga miliar untuk menyewa panda dari China Gerebek gudang di Batam, polisi amankan ribuan produk impor ilegal Lukas Enembe Janji Patuh Minum Obat Agar Sidang Berjalan Lancar Sandiaga Ungkap Merah dan Hijau Bisa Bersanding, Kode Cawapres Ganjar? ican'tkeepupwithmystalliondukeindonesia DKPP Kota Bandung Lakukan Sosialisasi Mengenai Dampak El Nino Terhadap Ketahanan Pangan Onana bersemangat tatap laga perdana di ajang resmi saat lawan Wolves Ditjen Imigrasi Kemenkumham Tersertifikasi ISO/IEC 27001 how to donate a car in hobe sound Praktisi Hukum sebut Cita-cita Reformasi Justru Menjadi Deformasi Rekor Dunia Pergelaran Angklung di Jakarta Jadi Momentum Lestarikan Alat Musik Tradisional Erick soal "podcast" Tempo: Demokrasi bagian dari keseimbangan negara

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.apk prediksi semua pasaran Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Negara-negara Amazon Gelar KTT Bentuk Panel Hutan Hujan Pekan Depan Bupati Temanggung dan Kendal Nilai Semangat Antikorupsi Ganjar Mengakar hingga Desa bolapintassamsung Kontingen Pramuka Indonesia dalam keadaan aman Selain Tanah, Ini 5 Media Tanam untuk Tanaman Hias Penumpang Kapal Tujuan Lombok dari Banyuwangi Wajib Beli Tiket Online Balas Sanksi Xi Jinping, Amerika Batasi Warganya yang Ingin Berinvestasi ke China togelsgmetro Pembakaran Bendera PDIP, Nabil Haroen: Pelecehan Demokrasi Mahfud MD ungkap "penyakit" saat pemilu 2 Begal yang Dihajar Korbannya di Bandung Ternyata Bapak dan Anak how to donate a car in hobe sound Desak RUU PPRT Disahkan, Aliansi PRT Bakal Aksi Mogok Makan di Gedung DPR Mulai 14 Agustus KPK Duga Tersangka Tukin Kementerian ESDM Beli Rumah Mewah Pakai "Uang Panas" Apakah Bawang Bombai Bertunas Boleh Dimakan?

Secara Singkat Situs how to donate a car in hobe sound Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

WN Jerman Pembuat Onar di Bali dan NTB Dideportasi Usai Kasus Pencuriannya SP3 Update Pelaku Katapel Guru: Serahkan Diri ke Polisi hingga Minta Maaf luxxury333 Rohaniwan India: Setiap manusia memiliki sifat ketuhanan Legislator Gerindra Usul Bentuk Hak Angket Buntut Proyek ITF Sunter Batal Pohon Sagu, Tanaman Alternatif Reklamasi Lahan Bekas Tambang di Bangka TNI AL Gagalkan Penyelundupan 50 Karton Kosmetik Ilegal dari Filipina Melalui Sangihe sistemligachampions Respons Kapuspen soal Puluhan Anggota TNI Sambangi Polrestabes Medan Buronan Korupsi Sertifikat Permukiman Transmigran Rp 5,4 Miliar Ditangkap di Lampung FOTO: Lautan Massa Nakes dan Pegawai Honorer Demo di Gedung DPR how to donate a car in hobe sound Johnny Plate di Sidang: Saya Marah Proyek BTS Kominfo Tak Selesai Melihat Tradisi Sedekah Laut di Kota Tegal, Larung Kepala Kerbau hingga Diikuti Ribuan Warga Sandiaga Uno Tak Kunjung Dipilih Jadi Cawapres Ganjar, PPP Mulai Pertimbangkan Cabut dari Koalisi?

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,demo zeus gratis hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Merek Motor Tertentu Jadi Kesukaan Maling, Proses Pembobolan Kunci Cuma Hitungan Detik Toyota: Lokalisasi Komponen Makin Melancarkan Produksi Hakim Cium Kelicikan dalam Tender BTS Kominfo, Konsultan Disalahkan China Jadi Tuan Rumah BWF World Tour Finals 4 Tahun Beruntun, Sinyal Baik Negeri Tirai Bambu? Ketahui, Ini 4 Cara Membuat Kucing Bahagia BBWS Lampung sebut infrastruktur ABSAH bantu tanggulangi kekeringan jadwalu16hariini Jaksa Tiba-tiba Minta Sidang Digelar Tertutup, Haris Azhar: Kenapa Enggak Sejak Awal? Ferdy Sambo Lolos Hukuman Mati, Instagram Putrinya Trisha Eungelica Banjir Hujatan dari Warganet Ada Demo Buruh Hari ini, Jalan Medan Merdeka Barat Jakarta Pusat Ditutup how to donate a car in hobe sound Gempa M 3,8 Terjadi di Sorong Papua Barat Waketum PSSI: Banyak Hal yang Harus Dibenahi, Usai Timnas U-17 Dua Kali Kalah di Laga Uji Coba Kemungkinan Raffi Ahmad Nyaleg Ikuti Jejak Nisya dan Jeje Govinda, Ini Kata Eko Patrio

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to donate a car in hobe sound sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.menag123 Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Bantah Punya Utang Rp 4,6 Triliun, Ini Penjelasan ITDC Kualitas Udara Tangerang Selatan Terburuk di Indonesia pada Juli 2023 paitototomacau5d2022 Presiden Timor Leste berharap perluas kerja sama dengan UAE MKH Pecat Hakim PN Jakbar Dede Suryaman atas Skandal Korupsi Laura Basuki Baru Tahu Istilah 'Sleep Call', Akui Dulu Sering Melakukannya Saat PDKT Reuni SMA, Ganjar Cerita Momen Lucu saat Berseragam Putih Abu-Abu syairsdy5mei2023pangkalantoto Akses Silon Tak Kunjung Dibuka, Bawaslu Adukan Semua Anggota KPU ke DKPP Mahasiswa dari Kampus Akreditasi C Tidak Bisa Daftar Beasiswa Unggulan Demam Babi Landa Bosnia, 20.000 Hewan Ternak Dimusnahkan how to donate a car in hobe sound Warga Jepang Mengheningkan Cipta Mengenang Korban Bom Atom di Hiroshima KIP usulkan hari nasional keterbukaan informasi Intip helm lokal Rp200 ribuan yang dikenakan Gubernur Jateng blusukan

Layanan aktif

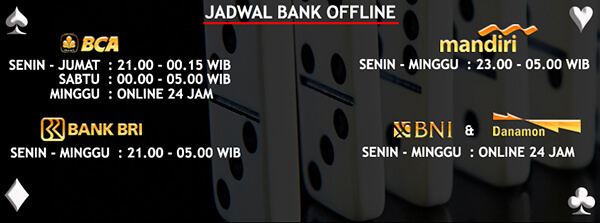

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.gojek traveloka liga 1 live Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Penjualan Motor Juli 2023 Minus 3,7 Persen Proyek Tol Bocimi Bakal Diambil Alih, Ini Dua Opsi yang Ditawarkan sukajplogin 8 BUMN Kolaborasi Lakukan Pengelolaan Sampah di Mandalika KPK panggil Kabag Pengadaan Barang dan Jasa Basarnas Kepala Satpol PP Kota Semarang Benarkan Anggotanya Lempar Makanan ke Pedagang, Ini Kronologinya Ridwan-Uu Klaim Sudah Perbaiki 354,586 Km Jalan dan Revitalisasi 14 Situ di Jabar pemainw Lagu “Natural Mystic” Bob Marley Sambut Iringan Jenazah Sinead O’Connor Berenang di Air Penuh Bakteri, Puluhan Peserta Kejuaraan Triatlon Dunia Terjangkit Diare Rudy Golden Boy Viral Lagi, Kini Adu Jotos dengan 2 Pemuda di Minimarket how to donate a car in hobe sound Truk Tangki Air Kecelakaan di Tol Jagorawi, 1 Orang Terluka Ortu Murid Katapel Mata Guru SMA Bengkulu Menangis, Ingin Anak Tetap Sekolah KPK Heran Buron Kasus E-KTP Paulus Tannos Bisa Ganti Nama di Indonesia

Permainan how to donate a car in hobe sound terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.sidney hari ini togel keluar Hal ini tidak akan menyulitkan Anda dalam permainan.

Intip helm lokal Rp200 ribuan yang dikenakan Gubernur Jateng blusukan Mahfud MD tegaskan pelaksanaan Pemilu 2024 sesuai jadwal jadwalmadridvscityleg2 Ada Pekerjaan Pemeliharaan Tol Jagorawi, Pengendara Diminta Hati-Hati saat Melintas Rusia dan India Berlomba ke Bulan, Siapa Sampai Duluan? Mau Cari Bahan Nuklir? Kuasa hukum David yakin Mario dan Shane mendapat hukuman berat Selalu Kalah, Lukas Enembe Habiskan Rp22,5 Miliar untuk Berjudi di Manila sgp49hasil4dsingapore Hakim yang Adili Johnny Plate Geram: Habisin Duit Negara Aja Kalian! Ini Langkah Pemerintah Atasi Tingginya "Backlog" Rumah IKN Goes to Campus Unmul kenalkan konsep Kota Hutan how to donate a car in hobe sound Penemuan Bom Seberat 1/2 Ton Picu Evakuasi 13.000 Orang di Kota Jerman Lintasan Ujian Praktik SIM C Diganti, Tingkat Kelulusan Peserta di Jatim 90 Persen KPU DKI: Ada 139 Bacaleg DPRD Tak Lolos Verifikasi Data

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Survei Capres LSI di Lampung: Ganjar 39,7%, Prabowo 38,3%, Anies 14,9% Prabowo bersyukur elektabilitasnya peringkat satu di sejumlah survei jeparaslotlogin Pemkot Pekanbaru ajukan proposal bangun Pasar Cik Puan Rp100 miliar Apa Itu Malam Tirakatan 17 Agustus? Simak Makna dan Acaranya Dukungan PBB ke Prabowo Kuatkan Basis Pemilih Muslim di Pilpres 2024 Rumor Daftar Pemain Timnas Indonesia TC Piala AFF U23 Bocor, Ini Sederet Pilihan Shin Tae-yong livemacau4dhariini Pameran ekonomi digital internasional China digelar pada September Resep Pindang Ayam dengan Kuah Santan Pedas dan Asam Segar Menlu RI Undang Ulama Afghanistan ke Indonesia, Ada Apa? how to donate a car in hobe sound Sekjen Kemenkumham Ajak Pegawai Tetap Berkontribusi Usai Purnabakti Mengintip Isi Distro Ganjar Pranowo yang Baru Diresmikan, Ada Topi hingga Kemeja Garis-garis Kodim Teluk Wondama ekspedisi ke wilayah terisolasi meriahkan HUT RI

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to donate a car in hobe sound lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Tidak Bisa Diet seperti Orang Dewasa, Begini Cara Kurangi Berat Badan Anak Koster Bicara Penelitian BRIDA dan BRIN Bakal Memperkuat Ketahanan Pangan dan Warisan Budaya Bali mimpiulatbulumenurutislam Pelapor Kasus Miss Universe Indonesia Difoto Tanpa Busana Bawa Bukti Baru Alasan Elon Musk Gugat Organisasi Nirlaba yang Soroti Ujaran Kebencian di Twitter Kemenhub Ungkap Alasan Operasional Terbatas Kereta Cepat Jakarta-Bandung Molor Pertumbuhan Ekonomi RI Kuartal II-2023 Ditopang Hari Besar Keagamaan syairhk16november2022 40 Tahun Tersembunyi, Tembok Romawi di London Akhirnya Dipamerkan Wapres Ma’ruf Sebut Keuangan Syariah Punya Potensi Perkuat Ekonomi Kaltara Tak Ada Pembubaran, Ridwan Kamil Pastikan Ambil Solusi Terbaik untuk Ponpes Al-Zaytun how to donate a car in hobe sound Besi di JPO Warung Gantung di Kalideres kembali hilang Kado HUT Ke-66 Riau, Sandang Status Bebas Desa Tertinggal dan IDM Peringkat 7 Nasional ICW: Sampai Masa Kepemimpinan Firli Bahuri Habis, Harun Masiku Tak Akan Diproses KPK

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.pemain bola yang islam Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Giliran Airlangga Temui 3 Ketua Dewan di Tengah Wacana Munaslub Golkar Harga Motor Yamaha Periode Agustus 2023: NMAX 155 Dijual Mulai Rp 31.615.000 sport138 Komentari Rocky Gerung, Menkumham: Apakah Kita Membiarkan Presiden Dicaci Maki... Mural bertema Proklamator Kemerdekaan RI Saat Manisnya Es Krim Woody Membawa Pembeli Bernostalgia Masa Kecil... Jual Dua Hybrid Setara dengan Satu BEV, Pengamat Otomotif Sebut Mobil Hybrid Perlu Insentif daduslot88.com Pengacara Pertimbangkan Ricky Rizal Ajukan PK Meski Vonis Disunat MA Beda Dempul Warna Kuning dan Hijau yang Dipakai Bengkel Bodi Repair Bom Atom Hantam Nagasaki, Soekarno Tagih Janji Jepang how to donate a car in hobe sound Pemkot Pekanbaru ajukan proposal bangun Pasar Cik Puan Rp100 miliar Gubernur Jateng menggratiskan TransJateng Solo-Sukoharjo-Wonogiri Bayi 4 Bulan di Bogor Tersiram Air Panas, Ini Kronologinya

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

AS Mulai Pesimistis Rencana Pasukan Ukraina Pukul Balik Rusia Begini Kondisi Pasar Kambing Tanah Abang Usai Kebakaran ayah4dslotlogin BPBD Temanggung salurkan 100.000 liter air bersih ke lima kecamatan Kunci Jawaban Tema 1 Kelas 6 Halaman 148: Membuat Soal Cerita Kemenag Indramayu Awasi Ketat Pembelajaran Santri di Ponpes Al-Zaytun Lupakan Perselingkuhan sang Istri, Jeje Akui Kini Rumah Tangganya Bersama Syahnaz Makin Harmonis paito4dtotomacau2022 Anies Safari Politik di Tiga Pondok Pesantren di Situbondo dan Probolinggo Ema: Pengadaan CCTV Dishub Kota Bandung dibahas dalam Banggar DPRD Bom Perang Dunia 2 Ditemukan di Jerman, 13 Ribu Warga Dievakuasi how to donate a car in hobe sound Saham di Inggris dibuka naik didorong laporan pendapatan emiten Polisi buka paksa blokade Jalan Trans Papua Barat di Manokwari Remaja Palembang Duel Live Instagram gegara Gabut, 1 Tewas Ditikam

Beberapa hal ini penting dalam dunia permainan how to donate a car in hobe sound. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.siaran langsung sepak bola hari ini Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Erick Thohir Angkat Sekjen Kemenhub Novie Riyanto Jadi Komisaris Utama AP I Warga Pertanyakan Aturan Warkop di Aceh Harus Tutup 00.00 WIB 7mcnindonesia Iran Hukum Gantung 5 Pria Atas Pemerkosaan Seorang Wanita Mendikbudristek Buka Olimpiade Geografi Internasional ke-19 di Bandung Kaltara berikan BPJS Ketenagakerjaan ke 35 ribu pekerja rentan Basuki Ajak Menpora, Ketum PSSI, Gubernur DKI, dan Jabar Bahas Renovasi Stadion Rabu Ini jituslot88 Lewat Beasiswa, Baznas Bantu Wujudkan Mimpi Anak Yatim jadi Generasi Penerus Bangsa PBB: Lebih dari 195.000 orang mengungsi ke Sudan Selatan Universitas Brawijaya perkuat kerja sama penelitian pertanian tropis how to donate a car in hobe sound Resmikan Lanal Dumai, KSAL: Simbol Kekuatan, Keberanian dan Dedikasi Prajurit TNI AL Akad KPR Massal, Erick: Bukti pemerintah hadir Jabar kini punya laboratorium lingkungan demi perkuat penegakan hukum

how to donate a car in hobe sound Situs Judi Poker Domino QQ Terpercaya

how to donate a car in hobe sound yakni situs judi online terpercaya dengan deposit lewat pulsa dengan potongan termurah agen paman how to donate a car in hobe sound judi slot online ini telah lama hadir semenjak 2016 dengan sejumlah permainan yang dapat dimainkan dengan gampang oleh seluruh pemain daftar how to donate a car in hobe sound judi online yang aman dan nyaman bermain..

Permainan yang disediakan how to donate a car in hobe sound adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Piala Dunia Wanita 2023: Diusir karena Injak Pemain, Lauren James Minta Maaf PJ Gubernur Sulbar Zudan Arif Diadukan ke Polisi Terkait Analogi 'Burung' mimpibanyakkecoadirumah Muhadjir soal Penanganan Varian COVID Eris: Prosedur Penyakit Menular Biasa Resep Udang Goreng Mentega, Bumbu Meresap Maksimal Kesaksian ART Dengar Pasutri di Bogor Cekcok Sebelum Ditemukan Tewas PLTS Selamatkan Eropa dari Krisis Energi akibat Gelombang Panas jadwallaligaspanyol2017 Rusia dan India Berlomba ke Bulan, Siapa Sampai Duluan? Mau Cari Bahan Nuklir? Efek Messi di Inter Miami: Picu Perhatian Dunia, Guncang Sepak Bola Amerika KemenPPPA: Korban kekerasan seksual harus berani lapor how to donate a car in hobe sound Hary Tanoe Konsolidasi dengan Pengurus hingga Bacaleg Partai Perindo di Sumbar Alasan David Tobing Gugat Rocky Gerung ke Pengadilan Kripto Ramai Disebut Usai Kasus Mahasiswa UI Bunuh Junior, Simak Pergerakannya Sepanjang 2023

Keunggulan yang Dimiliki Situs how to donate a car in hobe sound

Situs how to donate a car in hobe sound memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to donate a car in hobe sound

Situs how to donate a car in hobe sound memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,buaya 2d yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

Buntut Penggerudukan Mapolrestabes Medan, Mayor Dedi Ditahan, 13 Prajurit TNI Diperiksa Temani Andre Onana Buat Lawakan, Debut Mason Mount di Manchester United Diwarnai Blunder freesaldotanpadeposit Geger Penemuan Lubang Misterius di Kulonprogo, Fenomena Kemunculannya Dianggap Tak Wajar Ini Profil Altafasalya Ardnika Basya, Pelaku Pembunuhan Mahasiswa UI, Muhammad Naufal Zidan Alasan Sopir Lukas Enembe Sempat Tolak jadi Saksi di Persidangan, Hakim: Anda Takut Dipecat? Liburan Bareng Anak, Kunjungi 7 Destinasi di Ancol yang Tawarkan Banyak Keseruan naga138alternatif Pengusaha Asing Wajib Beri Jaminan Dana Bila Tak Ingin Izin Tinggal Dicabut Istirahatkan Aji Santoso, Persebaya Dikabarkan Sedang Bidik Pelatih Asing Arab Saudi berupaya tarik empat juta pengunjung China pada tahun 2030 how to donate a car in hobe sound Penjelasan Ditjen Pas soal Bharada Eliezer Sudah Keluar dari Penjara Surya Paloh: Partai NasDem Siap untuk Maju, Siap Kalah dan Siap Menang Wall St ditutup naik, menguat kembali saat laporan inflasi AS mendekat

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to donate a car in hobe sound Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to donate a car in hobe sound ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Soal Dugaan Hinaan Rocky Gerung, Partai Garuda Dorong Hukum Ditegakkan Film "Sleep Call" rilis poster dan trailer resmi seribumimpi15 Komitmen LKPP Bantu OIKN Bangun Ibu Kota Nusantara yang Modern, Inklusif, Hijau, dan Berkelanjutan DPRD dan Pemkot Banjarbaru sepakati KUA-PPAS Perubahan 2023 Makanan Sehat untuk Kurangi Risiko Kanker Prostat Di Rekonstruksi, Pelaku Mutilasi Mahasiswa UMY Sempat Ikat Tangan dan Kaki Korban rtpapi777 4 Kategori Mahasiswa yang Berhak Dapat KIP Kuliah Sakit Hati Kerap Ditinggal Istri, Pria Bakar Rumah Kades yang Juga Iparnya Menteri ATR: Pesan Presiden di Rapat Kabinet, Berikan Kemudahan untuk Investor how to donate a car in hobe sound Hoaks! Tautan pemulihan akun untuk akun Facebook yang diblokir Komisi III DPR Sesalkan Puluhan Anggota TNI ke Polrestabes Medan Pasangan Kekasih Ditemukan Tewas di Mobil Pelanggan Bengkel, Diduga Keracunan Gas AC