how to donate a car in eagle - Login Link Alternatif Terbaru dan RTP Slot mesothelioma123

Yuk, Intip Lebih Dalam Situs how to donate a car in eagle Yang Berkualitas

Argentina, Jerman & Negara Dengan Jumlah Kemenangan Terbanyak Di Piala Dunia | Goal.com Ruwet TC Timnas U-20, Antara Nasionalisme dan Profesionalisme herewithmelyricsd4vd Persiba Balikpapan Siap Ladeni Agresivitas Madura United | Goal.com Indonesia PS TNI Janji Tak Main Mata | Goal.com Indonesia Ridwan Kamil Pimpin Salat Ghaib di Pinggir Sungai Aare Andrea Pirlo Pahami Kemarahan Gianluigi Buffon | Goal.com Indonesia topgun77 Liverpool vs Manchester City: Rekor Tak Terlewati Virgil Van Dijk Akhirnya Patah | Goal.com Indonesia Video: Duka Ramadan, Bentrok di Masjid Al-Aqsa Sebelum Tunjuk Jesse Marsch, Leeds United Sempat Tertarik Pada Raul Gonzalez Sebagai Pengganti Marcelo Bielsa | Goal.com Indonesia how to donate a car in eagle Berita & Hasil Burkina Faso | Goal.com Beruntun, Miliarder Kripto Tewas Kecelakaan Helikopter Piala Dunia 2018 - FA Mesir Bantah Rumor Pensiun Mohamed Salah | Goal.com Indonesia

Yuk, Intip Lebih Dalam Situs how to donate a car in eagle Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to donate a car in eagle berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

Sri Mulyani Soal Tes Deteksi Covid-19: Hasilnya Negatif Golongan Usaha Ini 'Haram' Dapat PPh Final 0,5% fortunaslot77 Ini Target Produksi Komoditas Pangan Utama 2023, Cek! Sumur Resapan di Lebak Bulus Bikin Jalan Retak & Bergelombang Berita Juventus - Sepakati Kontrak Baru, Miralem Pjanic Bertahan Di Juventus | Goal.com Indonesia Persegres Gresik United Bidik Poin Di Tenggarong | Goal.com Indonesia bola45sgp Wakil Wali Kota Depok Minta PPPK Terus Tingkatkan Kinerja Gebrakan Menantu Luhut: Jadi Pangkostrad, Kini Naik Jabatan! Erik Ten Hag - Definisi Sesungguhnya Membangun Ulang Manchester United, Melestarikan Legasi Sir Alex Ferguson | Goal.com Indonesia how to donate a car in eagle Tambah 140, Pasien Sembuh Covid-19 di Depok Jadi 3.287 Orang Heboh AC Mati Penumpang Basah Kuyup, Air Jet Buka Suara Ini Alasan Palestina Umumkan Status Darurat

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.batakpoker Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to donate a car in eagle ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

Syekh Puji Datangi Polda Jateng Soal Kasus Pernikahan di Bawah Umur Jabar Masih Pimpin Tambahan Kasus Harian Terbanyak Covid-19 bolamerahkombinasihksdy Alvaro Morata Bergabung, Chelsea Kian Sulit Dibendung? | Goal.com Indonesia Ivan Perisic: Inter Milan Harus Kembali Ke Jalur Kemenangan | Goal.com Indonesia FOTO: Buka Puasa di Tengah Laga Everton vs Tottenham Thiago Motta Resmi Latih Genoa | Goal.com Indonesia keluaranhkprize123 Perang Masih Ngeri, Potret Rumah Warga Ukraina Dirudal Rusia Zlatan Ibrahimovic Bakal Absen Perkuat AC Milan Lawan Empoli | Goal.com Indonesia Berita Jeonnam Dragons v Seongnam, 08/04/23, K League 2 | Goal.com how to donate a car in eagle Raheem Sterling Absen Kontra Arsenal? | Goal.com Indonesia MU ke Final Piala FA, Ciuman Weghorst Jadi Sumber Petaka Brighton Thailand U-16 Bicara Target Lolos Piala Dunia U-17 | Goal.com Indonesia

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.pion77 Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Berita Arsenal: Denis Suarez Akan Jalani Debut Lawan Manchester City? | Goal.com Indonesia RESMI: Borneo FC Datangkan Pelatih Brasil Dengan Pengalaman Juara Di Korea Selatan | Goal.com Indonesia liveresulttaiwan Berita Italia v Inggris, 23/09/22, UEFA Nations League | Goal.com Berita PSG: Neymar Bahas Kontrak Baru | Goal.com Indonesia Breaking News: PM Inggris Liz Truss Mengundurkan Diri Arsenal Gulung Leicester City | Goal.com Indonesia vio88bet Dikontrak Jangka Panjang, Djadjang Nurdjaman Siap Orbitkan Pemain Muda Barito Putera | Goal.com Indonesia PSM Makassar Targetkan Dua Minggu Dapat Pengganti Robert Rene Alberts | Goal.com Indonesia Kinerja PT Bank Negara Indonesia (Persero) Tbk - Tahun 2011 Laba Bersih BNI Naik 42% Kredit Tumbuh 20%, DPK Naik 19% - Berita | BNI how to donate a car in eagle Cuma Bulan Ini! Tambah Daya Listrik Hanya Rp 202.100 Penerus Jaap Stam, Sven Botman, Dalam Proses Transfer Dari Lille Ke AC Milan | Goal.com Indonesia Tak Cuma Nikel, RI Ketiban Durian Runtuh Dari Harta Karun Ini

Secara Singkat Situs how to donate a car in eagle Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

Covid-19 Merebak Di Aston Villa, Liga Primer Inggris Ubah Jadwal | Goal.com Indonesia Dihajar Timnas Indonesia U-19, Pelatih Thailand Tak Masalah | Goal.com Indonesia snapsavefb Akhir Musim, Manchester City Bahas Perpanjangan Kontrak Dengan Pep Guardiola | Goal.com Indonesia Bensin Premium Bakal Dihapus? BPH Migas: Arahnya Begitu.. Leonardo Bonucci Kembali Latihan Bersama Juventus | Goal.com Indonesia Jerman vs Jepang, Balas Dendam Die Mannschaft Lawan Tim Asia dealer77 Berita Arema v Bali United, 17/06/17, Liga 1 | Goal.com Messi Ungkap Sinyal Mantap Pensiun 120 Ribu Usaha Terancam Gulung Tikar di Italia, Kok Bisa? how to donate a car in eagle Disinfektan Organik Buatan Yayasan Sahabat Ciliwung Dilirik KLHK Dewas KPK Periksa Firli Besok Soal Kebocoran Dokumen Penyelidikan Menpora Respons Kabar Indonesia Maju Jadi Tuan Rumah Piala Dunia U-17

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,ternate toto hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Meski Bapuk, Bos Atletico Madrid Diego Simeone Masih Ngefans Joao Felix | Goal.com Indonesia Telkom Terima Dua Penghargaan Anugerah Media Humas 2022 Lionel Messi: Saya Impikan Akhiri Karier Di Barcelona | Goal.com Indonesia Breaking News: Inflasi Mei Melandai, Tembus 0,09% Uzbekistan vs Indonesia: Cara Garuda Nusantara Jadi Juara Grup Striker Thailand Nilai Lawan Timnas Indonesia Akan Sulit | Goal.com Indonesia piringtototogel Berita & Transfer Pakhtakor | Goal.com Potret Pusat Perbelanjaan di Tengah Ramalan Ekonomi Suram RESMI: Paulo Fonseca Pelatih Baru AS Roma | Goal.com Indonesia how to donate a car in eagle Toyota Punya Calon 'Raja' Jalanan, Siap Suntik Mati Avanza? Buruh Cikarang-Karawang Merapat! Ini Bocoran UMP Jawa Barat Alisson Becker: Liverpool Mampu Lakukan Hal Spesial | Goal.com Indonesia

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to donate a car in eagle sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.rtp lembu 4d Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Kompetisi Bola Voli Proliga 2017 Jakarta BNI Taplus Siapkan Tim Lengkap Putra dan Putri - Berita | BNI Jose Mourinho Ungkap Faktor Yang Jadi Penghambat Manchester United | Goal.com Indonesia mamajitu Berita Mainz 05 v Union Berlin, 06/02/21, Bundesliga | Goal.com Banyak yang Belum Menyadari, Ini Dampak Nyata Pandemi Fenomena Aneh Resto-Resto Bertumbangan, Akhirnya Terjawab! Segini Jumlah Ekspor Tambang Mentah Yang Bikin Jokowi 'Murka' epicwin88 Bek Persib Bandung: Kekalahan Yang Menyakitkan | Goal.com Indonesia Rencana Persiraja Banda Aceh Sambut Lanjutan Liga 1 | Goal.com Indonesia ONE Fight Night 11: Eersel dan Ruotolo Sukses Pertahankan Gelar how to donate a car in eagle Andros Townsend: Wilfried Zaha Seharusnya Bermain Di Liga Champions | Goal.com Indonesia Berita Manchester United - Cedera Lutut, Eric Bailly Diprediksi Menepi Hingga Lima Bulan | Goal.com Indonesia Persiapkan Diri! Dunia Gelap Kian Nyata, Ini Bukti Terbarunya

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.prediksi jp sdy Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Berita PSM v Persib, 18/08/19, Liga 1 | Goal.com Erling Haaland & Emre Can Selebrasi Dengan Fans, Borussia Dortmund Didenda | Goal.com Indonesia jonislot Man City Permalukan Chelsea, Pep Guardiola: Itu Karena Saya Genius! | Goal.com Indonesia Debut Asnawi Mangkualam Di Korea Selatan Berujung Kemenangan | Goal.com Indonesia Mauro Icardi: Inter Milan Tak Terbiasa Kalah | Goal.com Indonesia CT Ungkap Sebuah Fenomena 'Lonely Economy': Aneh, Tapi Nyata! slot303 Aset Negara Bakal Disewakan untuk Bangun IKN, Apa Saja? Persegres Gresik United Antisipasi Kebangkitan PSS Sleman | Goal.com Indonesia SMPN 13 WAKILI PROVINSI JAWA BARAT KE TINGKAT NASIONAL LOMBA SEKOLAH SEHAT how to donate a car in eagle Berita Shakhtar Donetsk v Manchester City FC, 18/09/19, Liga Champions | Goal.com Hilton Moreira Sebut Pertahanan Persija Jakarta Solid | Goal.com Indonesia Kemenhub RI Gandeng Diskominfo Depok Perluas Informasi Soal Layanan Transportasi Publik

Permainan how to donate a car in eagle terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.data oregon 9 Hal ini tidak akan menyulitkan Anda dalam permainan.

Jangan Kaget Harga Mahal, Impor BBM Indonesia Segede Ini! Berita Argentina v Kolombia, 07/07/21, Copa America | Goal.com saktitoto Ramadan sebagai Momentum Literasi Alquran Heboh! Warga Negara NATO Ini Mau Caplok Wilayah Rusia Frank Lampard Tetap Ngotot Posisikan Timo Werner Di Chelsea Suka-Suka Dia | Goal.com Indonesia Berita Juventus: Maurizio Sarri Kembali Pimpin Latihan | Goal.com Indonesia dhx4dslotlogin Alvaro Morata Bergabung, Chelsea Kian Sulit Dibendung? | Goal.com Indonesia “Saya Ingin Bertahan Di AS Roma” - Pemain Pinjaman Arsenal Henrikh Mkhitaryan Berharap Dipermanenkan | Goal.com Indonesia Pelatih Baru Mitra Kukar Perlu Penerjemah | Goal.com Indonesia how to donate a car in eagle Joe Gomez Akan Dipinjamkan Ke Brighton & Hove Albion? | Goal.com Indonesia LaLiga 2022-23: Panduan Komprehensif Setiap Klub Termasuk Real Madrid & Barcelona | Goal.com Indonesia Piala Dunia 2022 Mulai Panas, Juaranya Sudah Ketahuan

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Berita EPL - Paul Merson Sebut Chelsea Akan Kalahkan Manchester United Di Piala FA | Goal.com Indonesia Antoine Griezmann Incar Jersey No.7 | Goal.com Indonesia oregon06togel Final UCL 2019 - Liverpool Ingin Perpanjang Kontrak Jurgen Klopp | Goal.com Indonesia Distribusi Hadiah & Subsidi Piala Presiden 2018 | Goal.com Indonesia “Juaranya Bayern Munich!” - Julian Nagelsmann Lempar Handuk Putih Tanda Menyerah | Goal.com Indonesia Gianluigi Buffon Merumput Pekan Depan | Goal.com Indonesia gocengqqalternatif Ratu Tisha Destria Mundur Dari Komite Kompetisi AFC | Goal.com Indonesia Berita Inter Milan - Luciano Spalletti Ingin Segera Pastikan Kontrak Untuk Mauro Icardi | Goal.com Indonesia WNI di Singapura Hati-hati, Covid Bisa Meledak 150.000/Hari how to donate a car in eagle BERITA - Go-Jek Jadi Sponsor Utama Persija Jakarta | Goal.com Indonesia Alvaro Morata Buat Takjub Fernando Torres | Goal.com Indonesia Amazon.Com Dituduh Curang

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to donate a car in eagle lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Fans Muslim Qatar Bentangkan Foto Mesut Ozil, Suporter Jerman Ngamuk & Ngajak Berantem | Goal.com Indonesia Berita Fiorentina v Lazio, 27/10/19, Serie A | Goal.com tangkasnet Anas dan Hasto PDIP Sentil SBY soal Chaos Politik: Jangan Buat Takut Formasi Mengerikan Villarreal Yang Siap Bikin Ole Gunnar Solskjaer Nol Gelar Di Man United | Goal.com Indonesia Berita Inter Milan - Inter Milan Masih Impikan Boyong Lionel Messi | Goal.com Indonesia Berulang Kali, Senayan City Kena Hoax Dijual donghuawebsite Minyak Ambles, Harga BBM April Akan Turun? Ini Kata Pertamina BPS: Neraca Dagang Juli 2022 Surplus USD 4,22 Miliar Miris! Ada Penjarahan di Tengah Banjir Meksiko how to donate a car in eagle Berita PSG: Kylian Mbappe Ukir Rekor Gol Di Ligue 1 Prancis | Goal.com Indonesia Forum Rencana Kerja Dinas Koperasi dan Usaha Mikro Kota Depok Pintu Air Pasar Ikan Siaga 2, Kelurahan di Jakut Waspada Banjir Rob

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.rajagacor Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

BERITA JUVENTUS - Atletico Madrid Tawar Paulo Dybala | Goal.com Indonesia Bekuk Liverpool, Thibaut Courtois: Real Madrid Dalam Posisi Bagus! | Goal.com Indonesia ajaib88 REVIEW LaLiga Spanyol: Bekuk Getafe, Sevilla Wujudkan Tujuh Kemenangan Beruntun | Goal.com Indonesia Arsenal Kalah, Manchester City Juara Liga Inggris Hotel Karantina Corona Ambruk di China, 26 Tewas 5 Fakta 'Wow' di Surplus Neraca Dagang Terbaik Sepanjang Masa mpoxllogin Minyak Ambles, Harga BBM April Akan Turun? Ini Kata Pertamina Negara Untung Banyak PNS Kerja Dari Mana Saja, Nih Buktinya! Liga 1 2019: Bhayangkara FC Jamu TIRA-Persikabo Di Stadion Madya | Goal.com Indonesia how to donate a car in eagle Berita Juventus - Juventus Mulai Rencana Pulangkan Paul Pogba | Goal.com Indonesia Beppe Marotta: Tak Ada Tanda-Tanda Lautaro Martinez Ingin Tinggalkan Inter Milan Untuk Barcelona | Goal.com Indonesia Skuad Portugal Di Piala Dunia 2022: Prediksi Line Up Vs Maroko & Pemain Bintang | Goal.com Indonesia

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Pelatih Vietnam U-16 Sebut Fans Indonesia Sedikit Lebih Liar | Goal.com Indonesia Arsenal Kritis, Arteta Justru Tak Sabar Bentrok Lawan Man City duaangka Berita Chelsea - Joe Cole Jagokan Eden Hazard Menangkan Ballon DOr | Goal.com Indonesia Lepas Banyak Pemain Muda Chelsea, Antonio Conte Beri Alasan | Goal.com Indonesia Simon McMenemy Cari Metode Untuk Atasi Krisis Striker Timnas Indonesia | Goal.com Indonesia Putin Warning NATO, Rusia Janji Balas Dendam Sanksi Barat mewahbet Rektor Universitas Negeri Padang Siap Sukseskan Implementasi DBON Usai Bentrokan, Ribuan Pekerja Smelter PT GNI Kembali Bekerja Situasi Terkini Ukraina: Warga Dideportasi, Rudal Menerjang how to donate a car in eagle Berita Real Madrid v Getafe, 09/02/21, LaLiga | Goal.com Harga Gula Mengamuk, Tembus Sampai Rp 16.000/Kg Gol Witan Bawa Indonesia Unggul 2-1 Atas Kamboja

Beberapa hal ini penting dalam dunia permainan how to donate a car in eagle. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.robintogel login Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Berita Persib Bandung: Robert Rene Alberts Sebut Pengalaman Achmad Jufriyanto Sudah Teruji | Goal.com Indonesia Honorer di Pemerintah Diganti Outsourcing, Buat Posisi Apa? ahlibet138 Toni Kroos: Jerman Bukan Tim Terbaik | Goal.com Indonesia VIDEO: Messi Minta Maaf ke PSG Usai Jalan-jalan ke Arab Saudi Olok-Olokan Guru Penjas, Mikel Arteta Buktikan Lebih Sakti Dari Manajer Legendaris Arsenal Arsene Wenger | Goal.com Indonesia Duit Konglomerat Martua Sitorus-Hamka Masuk Tol Terpanjang RI rtvgacor77 Jamu Inter Milan, Gelandang Bayern Munich: Kami Akan Bersenang-Senang | Goal.com Indonesia Batal Hijrah Ke Inggris, Thomas Lemar Bersyukur | Goal.com Indonesia Zlatan Ibrahimovic & Bintang Sepakbola Yang Tua-Tua Keladi | Goal.com how to donate a car in eagle Berita Real Madrid - Sergio Ramos: Saya Mungkin Ikuti Jejak Andres Iniesta Ke Tiongkok! | Goal.com Indonesia Buntut Insiden "Spygate", Akreditasi Wartawan Vietnam Dicabut | Goal.com Indonesia Harga Sepeda Ambruk, Diskon Toko Gede-Gedean

how to donate a car in eagle Situs Judi Poker Domino QQ Terpercaya

how to donate a car in eagle merupakan Situs Bandar Togel Online Resmi Terpercaya,how to donate a car in eagle Dilengkapi dengan operator profesional untuk memberikan pelayanan terbaik untuk anda..

Permainan yang disediakan how to donate a car in eagle adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Sikut Suporter, Sergio Aguero Bebas Dari Sanksi FA | Goal.com Indonesia Berita Aston Villa FC v Newcastle United FC, 23/01/21, Liga Primer | Goal.com tante4dslot Real Madrid Incar Remaja Rayan Cherki | Goal.com Indonesia DPRD Kota Bandung Setujui Raperda Pelayanan Pemakaman Umum Arsene Wenger: Arsenal Harus Siap Kehilangan Alexis Sanchez | Goal.com Indonesia Wakil Ketua Bidang 3 OASE-KIM Ucapkan Terima Kasih Kepada Menpora Amali terus Dukung Masyarakat Indonesia Sehat dan Bugar dunia777slot Pengelola PNPM di Kota Bandung Terkendala Pengadministrasian SPJ Ivan Kolev Kecewa Persija Jakarta Kebobolan Dua Kali | Goal.com Indonesia 10 FINALIS BANDUNG DATATHON 2021 how to donate a car in eagle 1 Juta Orang Sudah Meninggal, Doni: Covid-19 Bukan Konspirasi Raja Tega, Pedagang Tawar Murah Mobil yang Kena Diskon Pajak! Nih, Alasan Sri Mulyani Anggarkan Biaya Suplemen PNS di 2024

Keunggulan yang Dimiliki Situs how to donate a car in eagle

Situs how to donate a car in eagle memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

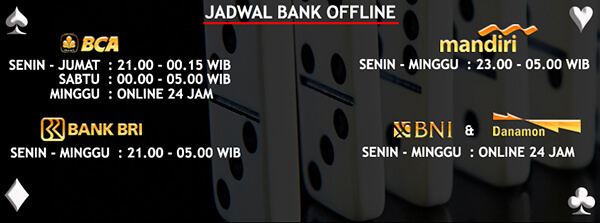

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to donate a car in eagle

Situs how to donate a car in eagle memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,jasaqq yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

Pelatih Filipina Sebut Timnas Indonesia U-16 Terlalu Kuat | Goal.com Indonesia Mauro Icardi: Belum Saatnya Gabung Real Madrid | Goal.com Indonesia depo77 Laporan Pertandingan: Las Palmas 0-5 Atletico Madrid | Goal.com Indonesia Prancis vs Belgia - Didier Deschamps Apresiasi Lini Belakang Prancis | Goal.com Indonesia Berita Sparta Rotterdam v PSV, 10/02/18, Eredivisie | Goal.com Antonio Conte Tinggalkan Inter Milan, Romelu Lukaku: Anda Mengubah Saya | Goal.com Indonesia taipan89 Berkat BPJS Kesehatan, Biaya Pengobatan Keluarga Dijamin Aman RESMI: Manchester City Tebus Julian Alvarez £14 Juta | Goal.com Indonesia Jokowi Bersyukur, Ekonomi RI Masih Positif di Tengah Krisis how to donate a car in eagle Kiper Manchester City Gavin Bazunu Segera Gabung Southampton Seharga £12 Juta | Goal.com Indonesia Akta Perkawinan Satu Penalti Gagal, PSS Sleman Kontra Persela Lamongan Imbang Tanpa Gol | Goal.com Indonesia

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to donate a car in eagle Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to donate a car in eagle ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Berita Arema v Bali United, 17/06/17, Liga 1 | Goal.com Sah! Bintang Chelsea Mudryk Pecahkan Rekor Pemain Tercepat Liga Primer Inggris | Goal.com Indonesia spin68slot RESMI: Zenit St Petersburg Tunjuk Roberto Mancini | Goal.com Indonesia China Mulai Sedot Harta Karun di Dekat RI Awas! PNS Bakal Makin Sedikit, Ini Biang Keroknya Olok-Olokan Guru Penjas, Mikel Arteta Buktikan Lebih Sakti Dari Manajer Legendaris Arsenal Arsene Wenger | Goal.com Indonesia wargodsystemsubindo Success Story PPKM: Corona Melambat, Ekonomi Menggeliat! Dewan Kemakmuran Masjid di Cimanggis Diimbau Terapkan Protkes Selama Ramadan Inter Milan Rilis Jersey Utama Musim 2018/19 | Goal.com Indonesia how to donate a car in eagle Kala Bos Pajak Buka Suara Soal PNS Pajak yang Ngemplang Pajak Pelatih Vietnam U-16 Sebut Fans Indonesia Sedikit Lebih Liar | Goal.com Indonesia Berita FC Salzbourg v Chelsea FC, 31/07/19, Club Friendlies | Goal.com