how to claim car insurance own damage in frederick : Situs Bo Togel Toto Macau Bet 100 Perak mesothelioma123

Yuk, Intip Lebih Dalam Situs how to claim car insurance own damage in frederick Yang Berkualitas

1.330 Jema'ah Non Kuota Masuk Saudi Sambut Era Revolusi Mental Dengan Kembangkan Lima Budaya Kerja mimpijembatan Pejabat Kemenag Jangan Terbawa Arus KKN Ditjen PHU dan PIHK Validasi Data Jamaah Berhak Lunas Daker Makkah Buka Layanan Bimbingan Ibadah Via Twitter Alasan Berhaji liriklagubutterflybts Abdurrohim, Juara Cabang 30 Juz Musabaqah Hafalan Al Quran Nasional Teliti Produk Halal, Kemenag Gandeng UGM RI Surati PBB Soal Instrumen Anti Penistaan Agama how to claim car insurance own damage in frederick Memeriahkan HAB, Hari Ini 4 Cabang Olahraga Dimulai Menag Sambut Baik Jambore Pasraman Hindu Menag: Reformasi Birokrasi diarahkan untuk Mempertajam Kinerja dan Pelayanan Masyarakat

Yuk, Intip Lebih Dalam Situs how to claim car insurance own damage in frederick Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to claim car insurance own damage in frederick berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

Menag: Program 2016 Harus Menjawab Kebutuhan Masyarakat Barcer Tak Dikirim ke Tanah Air, Kecuali Barang Berharga prediksijitucambodia4d Masih Banyak Jama'ah yang Menunaikan Haji Ifrad Muker Ulama Al Qur'an Akan Diikuti 12O Peserta Dubes Saudi: Indonesia Harus Bangga Punya Generasi Penghafal Al Quran Direktur PAI: K13 PAI Sekolah Ikut Kebijakan Sekolah menyundulbolayangbaikadalahmenggunakan... Menag: Kendalikan Hawa Nafsu Menag: Sejarah NU Terulang Penyelenggaran Haji 1436H Berjalan Sesuai Harapan how to claim car insurance own damage in frederick Menag: Santri dan Pramuka, Kombinasi Mentalitas yang Serasi Calhaj Khusus Tiba di Saudi Mulai 14 Oktober Cegah Kriminalitas, 500 Petugas Keamanan Wanita Saudi Diterjunkan

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.higgs domino dj tik tok 2022 Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to claim car insurance own damage in frederick ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

Air di Pemondokan Harus Dicek Setiap Pagi 3 Jemaah Dievakuasi ke BPHI Mekkah latihankekuatanbertujuanmeningkatkan Kemenag Kembangkan PAI Berkeunggulan Menag: Tunjukan Wajah Islam Rahmatan Lil Alamin 94.679 Haji Sudah Tiba di Tanah Air Kemenag Sampaikan Bantuan Bagi Korban Banjir Pandeglang akumenemukanmulirik Ini Kriteria Menag pada Kabinet Mendatang Ala LHS Lukmanul Hakim Yakub Dimakamkan di Taman Surga Kloter Awal, Ikut Nafar Awal how to claim car insurance own damage in frederick Penguatan Pendidikan Agama di Perbatasan Mendesak! 16 Kloter Terakhir Tinggalkan Makkah Besok Pimpinan Kemenag adalah ※PR§-nya Kemenag

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.lirik lagu peterpan bintang di surga Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Menag: Akar Masalah Kita adalah Tamak dan Rakus Sekjen Kemenag: Pemda Abaikan Pendidikan Langgar Konstitusi jadwalseagames2022caborsepakbola Menag Minta Mahasiswa Mengembangkan Kreativitas Pelunasan Tahap 2 Ditutup, Kuota Jamaah Haji Khusus Tersisa 255 Menag: Indonesia Laboratorium Kerukunan Umat Beragama Menag Baca Doa Apel Kehormatan di TMP Kalibata gambarejenali Wamenag: Qori Indonesia Diperhitungkan Negara Lain Ini Pemenang Lomba Fotografi dan Iklan Kerukunan Umat Beragama Menag Sidak Layanan KUA Kebayoran Baru how to claim car insurance own damage in frederick Menag: Jangan-Jangan Sebelum Lahir pun Saya Sudah NU Wamenag: Ekspekstasi Mayarakat Terhadap Kemenag Sangat Tinggi Jamaah Gelombang Terakhir Bersyukur Roudhoh Lebih Longgar

Secara Singkat Situs how to claim car insurance own damage in frederick Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

Menag: Jangan Haramkan APBD Biayai Pendidikan Agama Futsal Antar Aparatur, Semarakkan HAB 70 Kemenag codashopslot Embarkasi Solo Pegang Rekor Profesor Riset Astronomi-Astrofisika, LAPAN: Sidang Itsbat Sarana Mempersatukan Umat Kurangi Kepadatan Jamaah, PPIH Kirim Surat ke Kementerian Haji Daya Adaptasi dan Usia Lanjut, Faktor Gangguan Jiwa Jamaah arabhasbunallahwanikmalwakilnikmalmaula Menag: Kemenag dan Baznas, Harus Saling Menguatkan KH Hasyim Muzadi: Tidak Ada Ekstrimisme di Pesantren Tradisional KH Said Al-Munawwar: Tanpa Kitab Kuning, Pesantren Bukanlah Pesantren how to claim car insurance own damage in frederick Hadapi Cuaca Dingin, Jamaah Akan Diberi Penyuluhan Prestasi MAN IC Serpong Dalam Angka Irjen Suparta: Benar Aset Kemenag Paling Banyak

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,mpo108 slot hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Mengais Riyal Jamaah di Jeddah Wajah Kemenag Representasi Wajah Umat Beragama di Indonesia Sambutan Nyepi Menag : Momentum Untuk Saling Memberi Dukungan Moral Menag Harap Umat Khonghucu Internalisasi Kebajikan Khonghucu Hari Ini Terakhir Pemulangan Melalui Terminal Timur Bandara KAA ICIS 4 Promosikan Pendidikan Indonesia Yang Moderat dan Thariqah orangmancingkartun Berita Foto Kebakaran Hotel dan Pasar Tidak Benar Menag Buka Pionir VI Ini Lokasi Pengamatan Hilal Syawal 1434H how to claim car insurance own damage in frederick Musim Haji 2011, Jamaah Mengenakan Seragam Batik Menag Resmikan Laboratorium Praktikum Ibadah STAIN Jayapura 73 Persen Calhaj Sudah Berada di Arab Saudi

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to claim car insurance own damage in frederick sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.piala presiden ml Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Terima Komnas Perempuan, Menag Harap Beri Masukan RUU PUB Perencanaan Haji 2016 Dilakukan Lebih Awal downloadinginmemelukdirimu Proyek Konstruksi Mina Kurangi Areal Tenda Jamaah Menag: Dua Kata Kunci Peningkatan Kualitas Haji Kemenag Berencana Terbitkan Aturan Umrah 50 Ulama Berikan Bimbingan Manasik Jema'ah Haji login999slot KH Maruf Amin Terima Doktor Kehormatan Direktur PAI: K13 PAI Sekolah Ikut Kebijakan Sekolah MTQ Dekatkan Umat Islam dengan Al-Quran how to claim car insurance own damage in frederick Presiden Sby: Kita Bertekad Pelayanan Ibadah Haji Makin Baik Kedatangan Gelombang Kedua Dimulai Dirjen PHU: Tingkat Kepuasan Jemaah Haji 83 Persen

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.seventeen tour 2022 Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Menag Resmikan Kampus Putri Pondok Modern Assalam Sukabumi Riau Dinilai Berhasil Menjaga Kerukunan chorddantakseharusnyaaku Empat PTAI Minta Perubahan Status Himbauan Jama'ah Ketika Menerima Layanan Katering Menag: Peringatan Jubileum Momentum Tumbuhkan Solidaritas Anak Bangsa Gubernur Banten dan Sekjen Kemenag Bahas Persiapan Pospenas artinamaayunda Menag: Reformasi Birokrasi Harus Hadirkan Semangat Kerja dan Budaya Kerja Baru Menag : Akar Radikal Bukan Hanya Di Agama Tapi Juga Di Paham Demokrasi Ini Penjelasan Menag Soal Uang Muka Pemondokan how to claim car insurance own damage in frederick PPIH, Garuda, dan Muassah Akhirnya Duduk Bersama Ditinggal Armina, 7 Kamar Jama'ah Diacak-acak Pencuri Madrasah Dan Pesantren Harapan Utama Pendidikan Akhlak

Permainan how to claim car insurance own damage in frederick terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.naruto vs pain episode berapa Hal ini tidak akan menyulitkan Anda dalam permainan.

Indonesia Proses Santunan untuk Korban Crane BOS Madrasah Segera Bisa Dicairkan pemerandishinobinoittoki Kemenag Tambah Dua profesor Riset, Menjadi 12 Profesor Lagi, 2 Jamaah Indonesia Wafat Cegah Haji Non Kuota, Soal Visa Agar Dikoordinasikan dengan Kemenag Konferensi Islam Hasilkan 9 Rekomendasi warnacincinolimpiade Mekkah Hujan Lagi Cegah Gratifikasi, Kemenag Sosialisasikan PMA Nomor 24/2015 Menag: Zakat Solusi Terbaik Atasi Kesenjangan how to claim car insurance own damage in frederick Menag Ucapkan Selamat Natal Kepada Umat Kristiani Menag Himbau Jemaah Untuk Jaga Kesehatan Butuh Sosialisasi Penggunaan Teknologi, Kunci Kamar Dikira Kartu Voucher

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Menag: Saya Setuju Konsep Kesetaraan Gender Berbasis Wahyu Allah Bonus Demografi Tantangan Masa Depan Pendidikan Agama Islam nomortogelhksiang Kemenkes Kerahkan 2.000 Tenaga Medis Untuk Layanan Haji Menag Tahlilan Di Rumah Uje Dirjen PHU: Secara Umum Tahun Ini Lebih Bagus 60.047 Jamaah Sudah Meninggalkan Makkah rahmatunlil'alameenmp3 MUI Prihatin Masyarakat Mudah Mengakses Materi Pornografi Menag: Bus Shalawat Jamaah Haji Cukup Baik Saudi Tetapkan Wukuf di Arafah 5 November, Idul Adha 6 November how to claim car insurance own damage in frederick Cek Kaitan dengan NII KW 9, Menag ke Al Zaytun Rabu Menag Tindak Tegas PIHK dan Travel Haji Nakal Dokter Haji Khusus Jadi Korban Perampasan

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to claim car insurance own damage in frederick lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Aparatur Kemenag Harus Pahami Kebijakan Kehumasan Jamaah Haji Indonesia Terkenal Baik di Mata Dunia kodereferralbri Kemenag Juara Umum MTQ Nasional Korpri II Jamaah Haji Jateng Serahkan Bantuan Musibah Merapi Sukses di ISPO 2016, MTsN 1 Malang Targetkan Juara di Thailand Menag Minta Saran, Jamaah Usul Tiga Kali Makan angka51 Anak Muda, Ruh Kemajuan Bangsa Menag: Kerjasama RI - Saudi Sudah Terjalin Sangat Lama Untuk Safari Wukuf Disiapkan 10 Bus Khusus how to claim car insurance own damage in frederick Menag, Mendikbud, dan Menpan Tanda Tangani Aturan Pemanfaatan Guru dan Dosen Negeri 142.062 Jamaah Indonesia Sudah Berada di Makkah Menag: Radikalisme Itu Masalah Serius

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.semua permainan frozen Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Tiga Sasaran Pengamanan PAM Daker Makkah Satu Jamaah Wafat dalam Perjalanan Makkah-Madinah detikbola Pesan Wukuf Menag, Esensi Kemabruran Adalah Kepedulian dan Kedamaian Menag : Islam di Rusia Berkembang Baik Terkesan dengan Layanan Petugas, Bacan Seharga 5 Juta Rupiah Dijual 500 Riyal Menag Akan Hadiri Peringatan Lahirnya Pancasila di Mahad Al Zaitun liriklagutakkanhilangakumenanti Ditjen Pendis Gelar Asesmen Pegawai Sekjen : Insya Allah Pemondokan di Makkah 80 % di Ring I 20 Jamaah Haji UPG 30 Tolak Koper Dibongkar how to claim car insurance own damage in frederick Pembersihan Lantai Superkilat di Masjidil Haram Amirul Hajj Pimpin Rapat Persiapan Armina Sebagian Besar Jamaah Indonesia Sudah ke Mekah, Kota Madinah Mulai Sepi

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Hasyim Muzadi: Kemabruran Haji itu Hak Allah, Bukan DPR Menag: Buktikan Pada Dunia, Kemenag Bukan Pasar berapanomorhongkongkeluar Kemenag Siap Sukseskan UN 2014 Alat Masak dan Air Zam-Zam Dominasi Hasil Sweeping Bandara Wamenag Resmi Buka Pospenas VI di Gorontalo Delapan Perbedaan Penyelenggaraan Haji Indonesia dan Malaysia downloadrunningman77 Pilih Taxi ke Masjidil Haram Menag: Hubungan Baik Ulama-Umara Penentu Masa Depan Bangsa Gerakan Masyarakat Maghrib Mengaji Diintensifkan how to claim car insurance own damage in frederick Dirjen Bimas Islam: Melestarikan Perkawinan Tak Mudah Menag Launching PDF dan Satuan Pendidikan Muadalah pada Pontren Menag Launching Universitas NU Sumbar

Beberapa hal ini penting dalam dunia permainan how to claim car insurance own damage in frederick. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.spbolivescoore Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Banggalah Menjadi Petugas Haji 18 Kloter dengan 7.066 Jemaah Pulang ke Tanah Air liriklagusakatonikabc Cara Menag Temukenali Persoalan Kemenag Menag Minta Umat Jangan Terpancing Isu Pemindahan Makam Nabi Ahda Barori: Gelombang I Lancar, Gelombang II Siap Berjalan Fasilitas Jamaah Selama Di Madinah, Baik angkatogelayam Asrama Haji Batam Direnovasi Jelang MTQ Nasional Menag: Prioritas Yang Belum Berhaji Untuk Keadilan Berbalas Pesan, Bahrul - Nur Syam Beri Keteladanan how to claim car insurance own damage in frederick Indonesia Negara Pertama Punya Kementerian Agama Gorontalo Sudah Siap 100 Persen Naib Amirul Hajj: Arafah Momentum Merubah Diri

how to claim car insurance own damage in frederick Situs Judi Poker Domino QQ Terpercaya

how to claim car insurance own damage in frederick adalah situs slot how to claim car insurance own damage in frederick dengan system rtp kilat777 yang terakurat dan terupdate sehingga player gampang jp gampang menang dan gampang maxwin..

Permainan yang disediakan how to claim car insurance own damage in frederick adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Menag: Saifuddin Zuhri Ingin Jaga Indonesia Yang Religius dan Rukun Delay Penerbangan, Tiga Hotel Cadangan Dipakai artilaguruntah Menag Hadiri Jumenengan Paku Alam X Kemitraan Indonesia - Australia Bahas Grand Desain Peningkatan Mutu Madrasah Kemenag Akan Selenggarakan Dialog Nasional Ahmadiyah Menag dan IDB Segera Bahas Dana Pendidikan downloadlagubritneyspearsluckymp3 Kemenag Apresiasi kegiatan Magrib Mengaji Di Asshiddiqiyah Pemulangan Tiga Debarkasi Sudah Usai, Tersisa 19 Persen Lagi Madrasah Siap Gelar UN 2015 how to claim car insurance own damage in frederick Menag Resmikan STAIN Bengkulu Menjadi IAIN Belum Diputuskan Maskapai Lain Untuk Haji Setjen Kemenag Lantik Sejumlah Pejabat Eselon IV

Keunggulan yang Dimiliki Situs how to claim car insurance own damage in frederick

Situs how to claim car insurance own damage in frederick memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

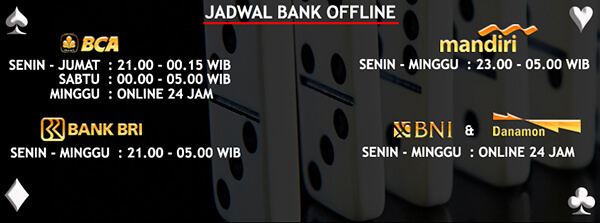

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to claim car insurance own damage in frederick

Situs how to claim car insurance own damage in frederick memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,login imogen yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

Sudah Enam Orang Jemaah Wafat di Madinah Menag dan Sekjen Rabithah Alam Islami Sepakati Kerjasama Pengembangan Umat operaminiapklama Kemenag Kembangkan Monitoring Satker Terintegrasi e-MPA Calhaj yang Wafat 2 Orang, 1 Menunggu COD Ini Rute Lomba Gerak Jalan Kerukunan Buang Kain Ihram Demi Mainan Unta untuk Cucu sepatubolaortushitam Jadikan MTQ Batam Monumen Kerukunan Umat Beragama Arab Saudi Hentikan Layanan Trasportasi 20.478 Jema'ah Haji Telah Tiba di Tanah Air how to claim car insurance own damage in frederick Sanksi Fatani Dihitung Berdasar Sisa Order Waspadai Jama'ah Mengalami Disorientasi Jemaah Diminta Gunakan Masker Antisipasi Flu Babi

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to claim car insurance own damage in frederick Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to claim car insurance own damage in frederick ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Kemenag Kerjasama Pertukaran Pelajar Dengan IFI Perancis Jangan Bawa Banyak Uang Ketika ke Masjidil Haram livebola168 Pemulangan Jemaah Khusus Lancar Kekerasan Atas Nama Solidaritas Tidak Bisa Dibenarkan Sulit Urus Paspor di Maktab untuk Jamaah Tanazul Menag: Seni dan Budaya Efektif Mendakwahkan Nilai-Nilai Islam bonusnewmember150slot Hindari Jema'ah Terpisah dari Rombongan, Kain Ihram Diberi Garis Biru Selamat Jalan Pak Ghafur Hajinya Cicit Pangeran Rangsang how to claim car insurance own damage in frederick Cegah Gratifikasi, Kemenag Sosialisasikan PMA Nomor 24/2015 Ukhuwwah Islamiyah Konsep Inklusif dan Universal, Tidak Ekslusif dan Sektarian Pemeluk Agama Yang Baik Akan Jadikan Indonesia Lebih Baik