how to car insurance quote in florham park : rtp live semua provider di mesothelioma123

Yuk, Intip Lebih Dalam Situs how to car insurance quote in florham park Yang Berkualitas

IMF: Corona Akan Picu Krisis Sosial Trump & Eropa Ragukan China, Corona Muncul dari Lab Wuhan? 88bett Menghidupkan Pariwisata Indonesia Pasca Merebaknya Corona Pernah Daftar Tapi Gagal, Ini Cara Ikut Lagi Kartu Prakerja Waspada! Corona Menyebar di 28 Negara, Tewaskan 2.247 Orang Logistik Dikecualikan Saat PSBB, Pengusaha Tetap Merana lgo88 AS vs Iran, Teheran Siapkan Drone Tempur Berjarak 1.500 Km Gara-Gara Pipa Gas Turki-Suriah Makin Panas Kritik Keras Presiden AS, Mahathir Minta Donald Trump Mundur! how to car insurance quote in florham park Wakil Presiden Iran Positif Terjangkit Corona Deretan Artis Hingga Olahragawan Yang Terjangkit Virus Corona Gebrakan ESDM : Gross Split Tak Wajib & Listrik Batal Naik

Yuk, Intip Lebih Dalam Situs how to car insurance quote in florham park Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how to car insurance quote in florham park berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

CEO New York Times: Media Cetak Bisa Bertahan 10 Tahun Lagi Luhut Pastikan RI Belum Terjangkit Virus Corona! slotolxtoto Hujan Lebat, Perumahan Green Garden Kedoya Kebanjiran! Usai Pukul Pemberontak, Bandara Aleppo Suriah Segera Dibuka Serba-serbi Tol Listrik Andalan PLN di Sumatra Utara Mengenal Aturan yang Bikin City Tak Bisa Ikut Liga Champions infini88engine Jokowi Perlu Marah Lagi? Ekonomi Loyo, Belum Ada Gebrakan! Tambah 7 Dalam Sehari, 85 Negara Tersengat Corona Istana: Omnibus Law Cegah Kucing-Kucingan Kontrak Kerja how to car insurance quote in florham park Tertekan Corona, Luhut: Pertumbuhan Ekonomi RI di Bawah 5% Corona Menggila, Iran Nyerah Minta Bantuan IMF! Pasien Virus Corona di Korsel Tembus 4.000, 22 Orang Tewas

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.pakar288 Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how to car insurance quote in florham park ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

Lega! Kasus Turun, Warga Negeri KPOP Boleh Kongkow Lagi Susiwijono: Omnibus Law 'Cilaka' Diselesaikan Secepatnya elangwim Resmi! Anies: PSBB DKI Jakarta Diperpanjang Sampai 22 Mei Jokowi Larang Mudik, Produsen Mobil Ngaku Tak Kaget! Catat! Ini Rute KRL yang Masih Terganggu Akibat Banjir OJK Bersih-Bersih Benalu di BPR Bali koi77. Bisnis Bus Pariwisata Babak Belur Dihantam Corona Ada Corona, Cerita Pusingnya Pengusaha Impor dari China 18 April KRL akan Di-Lockdown, PT KCI Tunggu Perintah! how to car insurance quote in florham park Kereta Made in Indonesia Mampu 'Keliling' Dunia Luhut: Corona Mengganas, Gerogoti Ekonomi Global 3 Bahan Pokok Ini RI Belum Merdeka dari Impor

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.ratu ceme Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Pilpres 2019, Habibie: Jangan Berpecah karena Pemilu 5 Tahun! 2 Pasien Corona di RI Boleh Pulang, tapi Ada Syaratnya omutogellink Galang Dana dari Milenial, Pemerintah Terbitkan Sukuk SR012 Sudah 34 Orang Positif Corona, RI Tanggap Darurat Catat! Tak Ada Ampun, Truk Obesitas Bakal Dipotong Ratusan Monyet di Thailand 'Tawuran' Kena Dampak Corona depositviapulsaim3tanpapotongan Sayonara! Kejayaan Sepeda Motor di RI akan Berakhir? Mentan Syahrul: Stok Beras Sangat Aman! Gaji ke-13 Belum Terlihat 'Hilal', THR PNS Sudah Pasti Nih how to car insurance quote in florham park Pengusaha: Perlu Diskusi Soal Penurunan Harga Batu Bara Corona! 493 Orang Meninggal hingga PDB Indonesia Tumbuh 5,02% Melihat Pemandangan Jakarta Barat yang Lumpuh Akibat Banjir

Secara Singkat Situs how to car insurance quote in florham park Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

Xi Jinping Sanjung Ratu Inggris Elizabeth II, Ada Apa Nih? AS Larang Kunjungan Wisatawan, Pengiriman Cargo Masih Normal slothoki777 Pasien Corona Indonesia 7135 Orang hingga Warga AS Demo Jerit Kelaparan TKI di Malaysia Ketika Lockdown Gopay Masih Rajai Dompet Digital Tanah Air Pencuri Ikan Marak Saat Covid, Susi Pudjiastuti: Tenggelamkan ratuslot138login Darurat Ekonomi Negara Oppa-Oppa Korea Karena Corona Tekor US$ 860 Juta, Awal Tahun Kurang Baik Neraca Dagang RI Covid-19 Bikin Ekonomi Dunia Babak Belur, Ini 7 Buktinya! how to car insurance quote in florham park Pemilihan Awal AS, Joe Biden Kecewa Menaker Ida Fauziah Jelaskan Tujuan RUU Omnibus Law Ciptaker Sayonara! Kejayaan Sepeda Motor di RI akan Berakhir?

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,uya 4d hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

RI Bertabur Global Bond Korporasi WHO Khawatir RI tak Bisa Deteksi Penyebaran Virus Corona Jabar Siapkan 28 RS Untuk Rujukan Pasien Virus Corona Di Tengah Serangan Corona, China Damaikan Perang Dagang ke AS Indonesia Tak Akan Pulangkan WNI Eks ISIS Buat yang Baru Tahu, RI Punya BUMN Nuklir Namanya INUKI mbo4dslot 19 April, Jumlah Pasien Positif Corona RI Menjadi 6.575 Kasus Usia Pasien yang Baru Dinyatakan Positif Corona: 33-34 Tahun BNPB: Corona Masuk Bencana Skala Nasional how to car insurance quote in florham park 3 WNI Terjangkit Corona di Diamond Prince, Ini Kata Kemenkes Kresna Asset Management Bantah Gagal Bayar Nasib Blok Minyak Raksasa: RI Susah Masuk, AS Jual Mahal?

Keuntungan Situs Permainan Untuk Anda

Situs permainan how to car insurance quote in florham park sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.jaya77slot Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Nasib Rencana Menhan Prabowo Borong 11 Sukhoi Su-35 Iuran Tak Lagi Naik, Tapi Relakah Anda Jika BPJS Bangkrut? nada777 Jokowi Siapkan Pulau Kosong untuk RS Khusus Penyakit Menular Lagi, Anies Ancam Beri Sanksi Perusahaan Pelanggar PSBB DKI! Protes Sri Mulyani, Pengusaha Plastik Tolak Kena Cukai RI Positif Corona, Pemeriksaan di Bandara Makin Ketat ultra88ai Bertemu Pemimpin Agama, Sandiaga Uno Janjikan Kesejahteraan Lebih Ngeri dari Corona, RI Bergantung Cabai Sampai HP China Heboh Pesangon, Dulu Mau Dihapus Kini Bakal Disunat how to car insurance quote in florham park Jokowi: Corona Ini Sangat Berbeda! Demo Berkepanjangan, China Copot Direktur Urusan Hong Kong Pengumuman! Lion Air Resmi Setop Layanan Penerbangan Umroh

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.padang jobs com Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Siapkan Saldo Lebih! Tarif 3 Ruas Tol Mau Naik Nih Streaming! Paparan Ekonomi CT, Sri Mulyani, & Erick Thohir akuratslotonline Sah, Indonesia Jadi Korban Perang Dagang! Ini Buktinya Waduh!! Singapore Airlines Kurangi Jumlah Penerbangan Melihat Kisah Klasik Sri Mulyani Bebaskan Pajak 11 Tahun Lalu Virus Corona Makin Ganas di Korsel, 893 Orang Terinfeksi agen138alternatif Soal Jiwasraya, Sri Mulyani Jawab Kegundahan Para Pengusaha Ekonomi Loyo, Jokowi: Yang Lain Anjlok Akhirnya, Hong Kong Tunda Pembahasan RUU Ekstradisi ke China how to car insurance quote in florham park Gegara Harga Gas Cs, Setoran Kas Negara dari ESDM Bisa Turun Prabowo Sindir Peresmian Tol Dikebut, Ini Kata Menteri PUPR Jet Tempur Saudi Ditembak Jatuh, Bakal Perang Lagi Nih?

Permainan how to car insurance quote in florham park terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.deli slot Hal ini tidak akan menyulitkan Anda dalam permainan.

Industri Migas Suram, RI Berharap Penuh Pada OPEC+ Jokowi Perintahkan 689 Anggota ISIS eks WNI Dicekal! iklanbarisgratistanpadaftar Heboh PM Australia Ragukan RI yang Kebal Virus Corona, Why? Ekonomi RI 'Tertular' Virus Corona, Butuh 'Vaksin' BLT 2 Tahun di Bulog, Buwas Susah Stabilkan Harga Selain Beras Sistem Upah akan Dirombak, Apa Saja Bocorannya? sbctoro Saat Sri Mulyani Katakan Ada Shock Besar di RI, Kenapa? Bukan Cuma Umroh, Saudi Larang WNA Masuk karena Corona Update Terbaru Virus Corona: 64.447 Terinfeksi, 1.492 Tewas how to car insurance quote in florham park BNI Berikan Bantuan Insentif & APD untuk Tenaga Medis Kenaikan Iuran BPJS yang Dibatalkan & Respons Sri Mulyani Diskon Pesawat 50% Soal Corona Dianggap Aneh, Kok Bisa?

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Harga Bawang Bombay Meroket: Izin Impor Baru 2.000 Ton Wapres Kena Corona, Solat Jumat di Iran Batal gatotkacaslot Menteri Pencetak Utang & Serangan Tim Prabowo ke PNS Kemenkeu Suriah Perang, Erdogan Temui Putin di Rusia Anies: Jakarta Berlomba dengan Kecepatan Penyebaran Virus Hikmah Defisit Neraca Perdagangan swissslot Kemenko Perekonomian Jelaskan Strategi RI Hadapi Imbas Corona Perangi Corona, Ini Sederet Instruksi Jokowi untuk Pemda Moeldoko: 689 Anggota ISIS Eks WNI Sudah Dikatakan Stateless how to car insurance quote in florham park Luhut Ungkap Puncak Wabah Covid-19 di RI, Kapan Pak? Menhub Pede Ada Diskon Tiket Pesawat, Turis Naik 40% Prancis Awasi Berbagai Tempat Kunjungan Turis

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how to car insurance quote in florham park lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Mal Cipinang Indah Jakarta Timur Kebanjiran! Ada Stimulus dari Trump, Simak Dulu Saham Pilihan Hari Ini big77login Jokowi Sudah Lapor SPT, Anda Kapan Nih? Stafsus Menkeu: Rasio Utang Terhadap PDB Bisa ke 35% Bertemu Pemimpin Agama, Sandiaga Uno Janjikan Kesejahteraan Duh! Investasi Mulai Terlihat Suram di Tengah Wabah COVID-19 hoki333slot Sejak Ada PSBB Jokowi, Belanja Ritel Online Melonjak 400% Cegah Wabah Corona, RI Pantau Ketat Pendatang dari Negara Ini Lampaui SARS, Korban Tewas Virus Corona Capai 806 Orang how to car insurance quote in florham park IMF: Corona Akan Picu Krisis Sosial Corona RI 15 April: 5.136 Positif, 446 Sembuh, 469 Meninggal 26 Anak Positif & 6 Meninggal Akibat Corona di Indonesia

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.toto 4d slot Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Mimpi Kereta Cepat Jakarta-Bandung Kian Dekati Kenyataan Citarum Mulai Bersih, Ridwan Kamil Raih Pujian Menko Luhut alternatif7meter Pekan Depan Jadi Babak Baru Kasus Jiwasraya China Pasok Sajadah Impor ke RI, Importir Kini Kelabakan Kabar Baik! Kasus Corona di China Turun ke Angka Terendah Menhub Siapkan Pasukan 'Starling' Bersepeda Listrik, Apa Itu? linkalternatifalfabet88 Ekonom: Siap-siap Resesi Global! Bagi Ekonomi, Corona Lebih Berbahaya Ketimbang SARS! Heboh Covid-19, Ini Beda Orang Dalam Pemantauan & Pengawasan how to car insurance quote in florham park Kejagung Tuntaskan Pemberkasan 3 Orang Tersangka Jiwasraya Begini Simulasi Penampakan Asteroid Raksasa yang Dekati Bumi Pesimisme Ekonomi Gara-Gara Corona

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Basuki Akui 169 Pegawai Terpapar, 1 Meninggal karena Covid-19 Pemerintah Setop Impor Binatang Hidup dari China an138 Bos Trans Corp Bicara Ancaman Bisnis Media Heboh Soal Gubernur Anies yang 'Kecolongan', Kenapa? Wapres Iran Positif Terjangkit Virus Corona Efek Virus Corona ke PDB: China Terkoreksi 2%, RI Turun 0,3% qq101alternatif Rame Nih! RI Jadi Tuan Rumah Indo-Pacific WEF 2020 Indonesia Tak Akan Pulangkan WNI Eks ISIS Dicurigai Trump Ciptakan Corona, Xi Jinping Telepon Putin how to car insurance quote in florham park Banjir Kepung Ibu Kota, Ini Jawaban Anies Baswedan Kuat Hadapi Corona, Kapan Swasembada Industri Kesehatan? Minta Warga Tak Panik, Polisi Ciduk 30 Orang Penimbun Masker

Beberapa hal ini penting dalam dunia permainan how to car insurance quote in florham park. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.mandirislot Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

DPR & BPH Migas Cek Operasional Kilang TPPI 70 Petugas Medis RS Mitra Keluarga Dirumahkan 71togel Menhub Siapkan Pasukan 'Starling' Bersepeda Listrik, Apa Itu? Batu Bara RI Dibayangi Corona, Investasi & PNBP 2020 Suram Tak Ada Infeksi Corona di Indonesia, Warga RI Justru Takut? Heboh Xi Jinping 'Hilang' Saat Wabah Corona Menjangkiti China pujaslot Terkonfirmasi, Pasien Tewas Corona di RI Warga Negara Inggris WHO Puji China Atasi Penyebaran Virus Corona Dicari-cari Karena Corona, Ternyata Xi Jinping di Sini how to car insurance quote in florham park Duterte Umumkan Manila 'Lockdown' karena Corona Di Korea Utara, 'Kabur' dari Karantina Corona Bakal Ditembak Singapura Pernah Tolak Status Negara Maju, RI Malah Bangga

how to car insurance quote in florham park Situs Judi Poker Domino QQ Terpercaya

how to car insurance quote in florham park Merupakan Bandar Judi Togel 4D Paling Besar Yang Menyediakan Hadiah 4D 10 Juta Rupiah Di Indonesia how to car insurance quote in florham park..

Permainan yang disediakan how to car insurance quote in florham park adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Begini Penampakan Terkini Stadion 'Old Trafford' Jakarta Ahok, Dari Komut Pertamina Jadi Pimpinan Ibu Kota Baru RI? mandirislot Ekonomi Melambat 5,02%, Jokowi: Jangan Kufur Nikmat! Data Perdagangan Tak Membantu, Rupiah Lesu Gegara Isu Resesi Canggih! Intip Penampakan Kapal Perang Karya Anak Bangsa Ini Anies Akui KRL Jakarta-Bogor Paling Rentan Penyebaran Corona comtotologin 238 WNI Bebas Corona, Jokowi: Mari Terima dengan Ikhlas Pemerintahan Tutup 35 Hari, PNS AS Trauma WHO: Dunia Terancam Kekurangan Peralatan Medis how to car insurance quote in florham park Anies Ungkap Skenario Terburuk Potensi 6.000 Kasus Corona 18 April, Jumlah Pasien Positif Corona RI Mencapai 6.248 Dana BOS Rp 9,8 T Tahap I Resmi Mengalir ke 136.579 Sekolah

Keunggulan yang Dimiliki Situs how to car insurance quote in florham park

Situs how to car insurance quote in florham park memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

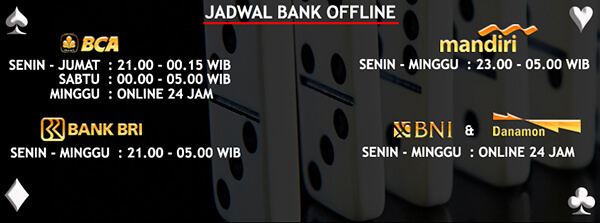

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how to car insurance quote in florham park

Situs how to car insurance quote in florham park memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,lakutoto togel yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

7 Mobil Nginap di Soetta Setahun Lebih, Parkirnya Rp 893 Juta Bagaimana Kondisi Prabowo Saat ini? Ini Penjelasannya maxbet338 Pertamina Bagikan 6.643 Paket Bantuan untuk Pekerja Perempuan Dituntut Rp 90 Ribu T karena Corona, Ini Respons Resmi China Korban Corona Bertambah, RI Akhirnya Setop Ekspor Masker Lebanon Kembali Dilanda Kericuhan slot3dbet Di Depan Aktivis 98, Jokowi Janji Bakal Ambil Keputusan Gila Tarif Tak Naik, PLN Putar Akal Cari Duit Investasi Listrik Makin Gemuk! Utang Luar Negeri RI Lompat 10,1% ke Rp 5.681 T how to car insurance quote in florham park Corona Kepung Eropa, Prancis Umumkan Lockdown Nielsen: Total Belanja Iklan 2017 Capai Rp 145 Triliun Kemenangan Jokowi-Ma'ruf Hingga Pendiri Sinar Mas Wafat

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how to car insurance quote in florham park Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how to car insurance quote in florham park ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Begini Fakta-fakta Seputar Longsor Dekat Jalan Tol Cipularang Begini Penampakan Erupsi Gunung Merapi yang Mencapai 2.000 M mpo200slot Bulog Minta Masyarakat Tenang: Beras Aman Hingga Akhir Tahun Panas Lagi! Israel Bombardir Damaskus, 7 Orang Tewas Terungkap! Ini Bocoran Uang Bonus 5 Kali Gaji Buat Pekerja Kemenkomarves: Corona Ganggu Potensi Investasi USD 10 M di RI slotkompastoto Sempat Lumpuh, Menhub Pastikan Bandara Halim Beroperasi Lagi Ini Dampak Corona ke Sektor Ekonomi Indonesia Kantor Nokia di Menara Mulia Mau Disterilkan, Corona kah? how to car insurance quote in florham park AS Paling Banyak Beli 'Surat Utang Terbesar dalam Sejarah RI' Kenapa Pertamina Belum Turunkan Harga BBM? Bom Perang Dunia Dipindahkan, London City Airport Akan Dibuka