how auto insurance is in vallejo : Situs game paling berpengaruh mesothelioma123

Yuk, Intip Lebih Dalam Situs how auto insurance is in vallejo Yang Berkualitas

Proyek Listrik Raksasa RI Terus Molor, AS Biang Keroknya? Pemerintah Hati-hati! Ramai PNS dengan Pola Pikir 'Berbahaya' win88slotlogin PREVIEW La Liga Spanyol: Real Madrid vs Leganes | Goal.com Indonesia Berita PSIS Semarang v Borneo, 06/06/18, Liga 1 | Goal.com Laporan Pertandingan: AC Milan 1-0 Inter Milan [AET] | Goal.com Indonesia BERITA MU - Gary Neville: Kepergian Zlatan Ibrahimovic Akan Lukai Manchester United | Goal.com Indonesia hcs77slot Tabung Gas Meledak di Jakbar: 4 Rumah Rusak, 1 Korban Dibawa ke RS Christian Vieri Prediksi Harga Erling Haaland Bisa Tembus €300 Juta | Goal.com Indonesia Liverpool BANTING Manchester United Kembali Ke Tanah! Kala Gakpo, Nunez, Dan Salah Hancurkan Euforia MU Di Anfield | Goal.com Indonesia how auto insurance is in vallejo Cair Maksimal H-7, Ini Aturan Lengkap THR Pegawai Swasta 2023 Hasil Pertandingan: Fulham 1-2 Liverpool | Goal.com Indonesia Industri Dapat Gas Murah, Begini Efeknya..

Yuk, Intip Lebih Dalam Situs how auto insurance is in vallejo Yang Berkualitas! Bermain tentunya menjadi salah satu kegiatan dari sedikitnya kegiatan menyenangkan yang dapat Anda lakukan. Jelas saja,how auto insurance is in vallejo berbeda dengan bekerja, saat bermain semua beban yang ada dalam benak Anda akan menghilang. Maka karena itu, menjadi hal yang sangat wajar bila saat ini semua dari Anda dapat menemukan aplikasi permainan di ponsel dengan mudah.

Khawatir Kondisi Christian Pulisic, Bos Chelsea Thomas Tuchel Desak Pelatih Amerika Serikat Gregg Berhalter Untuk Hati-Hati | Goal.com Indonesia Berita Chelsea FC v AFC Bournemouth, 31/01/18, Liga Primer | Goal.com demopowerofodin Alejandro Garnacho Rasa Macheda! Manchester United Dramatis Benamkan Fulham | Goal.com Indonesia Nasib Gianluigi Donnarumma Belum Dipastikan | Goal.com Indonesia Jangan Kaget, Korsel Butuh Banyak Tukang Las Asal RI Lho Real Madrid Gelar Rapat Dadakan Terkait Kasus Korupsi Wasit Barcelona, Ada Apa!? | Goal.com Indonesia lucky77login Top! Produksi Batu Bara RI Pecah Rekor Tembus 687 Juta Ton Sinar Dante Di Pekan Pembuka Ligue 1 | Goal.com Indonesia Berita La Liga Spanyol - Diego Simeone: Atletico Madrid Akan Kejar Barcelona Sampai Penghabisan | Goal.com Indonesia how auto insurance is in vallejo Putin Rilis 'Senjata' Baru, Bisa Bikin Barat Takut? Madrid Vs Man City, Ancelotti: Haaland Berbeda, Besar, Berbahaya Berita Borussia Dortmund v Real Madrid, 26/09/17, Liga Champions | Goal.com

Akan tetapi, selain menggunakan aplikasi, ada hal lain yang dapat Anda gunakan untuk bermain. Hal tersebut adalah jelajah internet yang masih menjadi bagian dari ponsel Anda. Dengan menggunakan jelajah internet ini, ada banyak permainan menarik yang dapat Anda temukan pula. Salah satunya adalah permainan yang telah menjadi incaran masyarakat luas sejak zaman dahulu.link halo88 Bahkan, beberapa dari Anda juga mungkin akan memilih permainan ini.

Benar sekali, hal ini dikarenakan hadiah kemenangan yang diberikan oleh permainan yang ada dalam situs ini adalah uang. Tepat sekali, judi menjadi nama lain dari permainan yang saat ini dapat Anda mainkan dalam situs dengan nama how auto insurance is in vallejo ini. Kami menyarankan semua dari Anda untuk langsung mengunjungi situs yang kami sebut sebelumnya saja saat ingin bermain. Hal ini dikarenakan situs yang kami sebutkan merupakan laman yang aman.

Horor Covid Hong Kong: Mayat-mayat Numpuk, Rumah Duka Penuh Bareng Uji Coba Timnas Indonesia, Jadwal Liga 1 Bakal Digeser | Goal.com Indonesia rupiah168 Liga 1 2019: Dua Pemain Borneo FC Mulai Pulih Dari Cedera | Goal.com Indonesia Firli Apriansyah: Tidak Mudah Di Posisi Satu | Goal.com Indonesia Presiden Galatasaray: Inter Milan Terlalu Menuntut Soal Yuto Nagatomo | Goal.com Indonesia Jose Mourinho Ucapkan Terima Kasih Pada Wasit Yang Usir Ander Herrera | Goal.com Indonesia biayakuliahuninus Proyek Pengganti LPG Tanpa Uang Negara, Yakin Bisa Jalan? Operasi Lutut, Zlatan Ibrahimovic Tidak Bisa Bermain Hingga 2023 | Goal.com Indonesia Michael Ballack: Tak Banyak Pemain Yang Menghina Jose Mourinho | Goal.com Indonesia how auto insurance is in vallejo Ngeri! Ini Bukti Rekor Panas Asia Tenggara Tak Ada Habisnya Massimiliano Allegri: Juventus Bakal Hukum Douglas Costa | Goal.com Indonesia Jose Mourinho: Saya Kangen Wayne Rooney | Goal.com Indonesia

Jelas saja, ada banyak keuntungan yang diberikan oleh laman ini dan tidak hanya berlaku untuk pemenang. Benar, hal ini dikarenakan keuntungan ini berlaku untuk semua dari Anda yang menjadi anggota dari situs ini. Lebih tepatnya, keuntungan ini dapat Anda peroleh dari banyaknya pelayanan terbaik yang biasanya tidak diberikan laman lain.sahabat poker Mengetahui hal ini tentunya membuat Anda merasa penasaran dengan laman ini, bukan?

Gawat, RI Menghadapi Krisis Baru, Bakal Berat! Piala Gubernur Kaltim 2018: Persebaya Surabaya Singkirkan Tuan Rumah | Goal.com Indonesia mvp99slotlogin Bareng Uji Coba Timnas Indonesia, Jadwal Liga 1 Bakal Digeser | Goal.com Indonesia Penuh Tanda Tanya, Thomas Doll Kecewa Dengan Permainan Persija | Goal.com Indonesia AC Milan Bungkam Atalanta, Terus Pepet Napoli | Goal.com Indonesia Misbakus Solikin Ambisi Bobol Gawang Persinga Ngawi Lagi | Goal.com Indonesia totalwla2 RI Mau Negara Maju, Ini PR Besarnya! Tiga Penggawa Anyar Gabung Pemusatan Latihan Persib | Goal.com Indonesia JK Ingatkan Jokowi! Hasil Bumi RI Milik Rakyat, Bukan Asing how auto insurance is in vallejo Ternyata Ini yang Diharapkan Jokowi dari Joe Biden Breaking: Inflasi Jerman Melejit Lagi, Capai 7,9% di Agustus Usai Kena Tsunami Corona, Ekonomi Negara Ini Diramal Terbang

Secara Singkat Situs how auto insurance is in vallejo Untuk Anda

Kami akan menjawab semua rasa penasaran Anda mengenai situs ini terlebih dahulu. Dengan melakukan hal ini, maka semua pertanyaan yang ada dalam benak Anda tentunya akan menghilang. Sebab, kami akan membuat Anda mengetahui laman ini secara lebih dalam lagi. Hal paling awal yang harus Anda ketahui mengenai laman ini adalah kemudahan yang diberikan kepada Anda sebagai anggota dari laman.

SIMAK! Duel Smackdown Ferran Torres vs Stefan Savic Dalam Laga Sengit Atletico vs Barcelona | Goal.com Indonesia Satu Lagi Talenta Muda Tolak Inggris, Terkini Ada Yunus Musah Pilih Amerika Serikat | Goal.com Indonesia pay4ddaftar Inter Terima Tawaran Manchester United Untuk Ivan Perisic | Goal.com Indonesia Laporan Pertandingan: Benevento 2-2 AC Milan | Goal.com Indonesia Gerai UMKM Center Ratujaya Makin Eksis di Bulan Ramadan India Doyan Larang Ekspor, Hati-hati Senjata Makan Tuan kelasbintangmovie Liverpool vs Barcelona - Kejeniusan Trent Alexander-Arnold Panen Pujian | Goal.com Indonesia Berita Bola - Menang 27-0, Pelatih Tim Muda Di Italia Justru Dipecat | Goal.com Indonesia Penanggung Biaya Pengobatan David Ozora Punya Aset Fantastis how auto insurance is in vallejo Timor Leste U-19 Main Di Bawah Tekanan | Goal.com Indonesia Madura United Kecewa EPA Tak Dapat Perhatian | Goal.com Indonesia Pengakuan Jokowi: Anies Cs Ada 'Duit Simpanan' Redam Inflasi

Saat memutuskan untuk menggunakan situs ini, maka semua dari Anda akan menemukan nominal deposit yang wahai hingga permainan yang beragam. Hal ini jelas merupakan keuntungan untuk semua dari Anda. Akan tetapi, keuntungan ini juga masih menjadi bagian kecil dari situs yang ini.

Tentunya,surga dewa slot login link alternatif hal ini dapat terjadi karena ada lebih banyak keuntungan yang akan menjadi milik Anda. Beberapa keuntungan tersebut akan menjadi hal yang Anda temukan dalam kalimat selanjutnya. Maka karena itu, cari tahu bersama kami dengan tetap menyimak setiap kalimat yang ada dengan baik.

Kai Havertz: Thomas Tuchel Selalu Tuntut Yang Terbaik | Goal.com Indonesia Teka-Teki Masa Depan Cristiano Ronaldo Di Juventus Terjawab | Goal.com Indonesia Dishub dan Polres Metro Depok Tutup Lima U-Turn di GDC Leonardo Bonucci: Italia Pulang Dengan Kepala Tegak | Goal.com Indonesia Yunus Nusi: Saya Tak Pantas Jadi Waketum, Kecuali Bapak Zainudin Amali Video: Bedah Kemelut Utang BUMN Karya, Apa Yang Salah? playslots88 Penyebab Marko Simic Pulang Kampung | Goal.com Indonesia Roy Keane: Tidak Sama Performa Paul Pogba Untuk Manchester United & Prancis | Goal.com Indonesia Berita Liverpool - Andy Robertson Puji Takumi Minamino | Goal.com Indonesia how auto insurance is in vallejo Menpora Amali: Selamat Jalan Markis Kido, Semangat Juangmu Jadi Contoh Pebulutangkis Muda Indonesia Kang Pisman pun Sejahterakan Warga Ketum KONI Pusat Harap Sinergitas dan Soliditas Para Pemangku Kepentingan Olahraga Dalam Pembinaan Prestasi Atlet

Keuntungan Situs Permainan Untuk Anda

Situs permainan how auto insurance is in vallejo sendiri mampu memberikan beragam keuntungan untuk Anda. Tidak akan menjadi hal yang mudah untuk mendapatkan keuntungan dalam beragam agen lainnya. Namun, situs permainan ini mampu memberikan penawaran sempurna dalam permainan hanya dengan pembuatan akun permainan saja.ehm297 Pastinya, ada beberapa keuntungan berikut ini yang akan Anda dapatkan dalam dunia permainan tanpa perlu kesulitan sama sekali.

Tiga Dari Ajax! Ini Sepuluh Pencetak Gol Termuda Di Fase Gugur Liga Champions | Goal.com Nigeria Vs Argentina - Javier Mascherano: Lionel Messi Bertekad Ubah Situasi Argentina | Goal.com Indonesia qqmilanslotlogin Entaskan Kasus Stunting, Panmas Siap Sukseskan Program D'Sunting Menara Bansos Jokowi Segera Dibagi, Cukup Redam Efek Harga BBM? Brentford Vs Chelsea: Live Streaming & TV, Prediksi, Susunan Pemain Dan Kabar Terkini | Goal.com Indonesia Lucas Hernandez: Saya Butuh Alphonso Davies Sebagai Saingan Di Bayern Munich | Goal.com Indonesia parisslotalternatif Filosofi Gubernur Viktor: Ingin Siapkan Tokoh Sebelum Mentari Terbit Robert Alberts Berharap Pemain Persib Bandung Di Timnas Indonesia Tetap Bisa Main Di Liga 1 | Goal.com Indonesia PESTA PENDIDIKAN 2017 how auto insurance is in vallejo Berita Sriwijaya v Persib, 01/04/18, Liga 1 | Goal.com Berita Barcelona - Patrick Kluivert Sarankan Ansu Fati Turun Ke Tim B | Goal.com Indonesia Cair! PLN Sudah Terima Rp 5 Triliun Modal dari Sri Mulyani

Layanan aktif

Anda mendapatkan penawaran sempurna dalam permainan berupa layanan yang aktif. Anda dapat bermain tanpa masalah sama sekali dalam urusan waktu. Semua permainan yang ingin Anda mainkan dapat disesuaikan dengan kenyamanan untuk taruhan.hoki222 login Para pemain biasanya memikirkan waktu terbaik karena harus menyesuaikan dengan tempat permainan sendiri. Namun, situs ini mmberikan penawaran sempurna untuk permainan dengan akses 24 jam.

Gelandang Timnas Indonesia U-19 Bingung Perbedaan Indra Sjafri Dengan Luis Milla | Goal.com Indonesia TC Timnas Indonesia untuk Lawan Burundi Dimulai 20 Maret bejobet Survei GOAL: Seberapa Antusias Anda Menyambut Piala Dunia 2022? | Goal.com Indonesia Transmart Full Day Resmi Dibuka, Semua Serba Diskon 20% Berita Transfer - Tuntut Gaji Tinggi, Manchester United Akhiri Pengejaran Paulo Dybala | Goal.com Indonesia KPK Klarifikasi Bupati Bolaang Mongondow Utara soal LHKPN embaslot Berita Wolverhampton Wanderers v Everton FC, 11/08/18, Liga Primer | Goal.com Good News! Sandiaga Uno Izinkan Konser Musik Digelar Terbatas Strategi Jitu Pemkot Depok Tekan Laju Inflasi how auto insurance is in vallejo Mengapa Presiden Andrea Agnelli, Pavel Nedved & Semua Direksi Mundur Barengan Dari Juventus? | Goal.com Indonesia Berikut Jadwal Siaran Kanal Youtube Pembelajaran Online Singapura Temukan Lagi 2 Orang Positif Omicron

Permainan how auto insurance is in vallejo terbaik

Tidak hanya penawaran untuk permainan selama 24 jam saja. Anda juga mendapatkan layanan lainnya dalam permainan. Hal ini berkaitan dengan banyaknya permainan yang dapat Anda akses tanpa perlu kesulitan sama sekali. Semua permainan mempunyai perbedaannya satu dengan yang lain. Anda dapat meraih kemenangan permainan dengan akses pada permainan yang tepat.4dp Hal ini tidak akan menyulitkan Anda dalam permainan.

Kolam Retensi Gedebage, Tuntaskan Banjir Sekaligus Ruang Publik Baru Dias Angga Putra Sulit Tolak Tawaran Bali United | Goal.com Indonesia arenadewaslot Paulo Dybala - Dibenci Juventus, Dicintai Suporter | Goal.com Indonesia Juan Mata: Ini Terasa Seperti Kekalahan | Goal.com Indonesia Desainer IKM Fesyen Depok Tampilkan Rancangan Busana di Indonesia Fashion Week 2023 Lionel Messi Ke Inter Miami, Bos Barcelona Xavi Bilang Begini | Goal.com Indonesia surga88 Cedera Samuel Umtiti Jadi Kehilangan Besar Buat Barcelona | Goal.com Indonesia Persib vs Borneo: Robert Rene Alberts Bertekad Bangkit | Goal.com Indonesia BLT Ojek, Nelayan & UMKM Segera Cair, Penerima Dapat Berapa? how auto insurance is in vallejo Tidak Cuma Deklarasi, G20 Juga Hasilkan Concrete Deliverables Michael Owen: Liverpool Akan Dikenang Sebagai Salah Satu Yang Terbaik Di Liga Primer Inggris | Goal.com Indonesia Ronaldo Dibenci Fans Turki Gara-gara Tak Bantu Korban Gempa

Tampilan permainan menarik

Anda pastinya ingin mendapatkan penampilan permainan yang sempurna untuk suasana yang jauh lebih menarik. Tidak akan jadi hal yang seru jika permainan hanya dapat Anda akses dengan warna biasa saja. Situs permainan ini memberikan beragam fitur menarik sehingga semua permainan jauh lebih menarik. Walaupun permainan dimainkan secara daring, Anda tetap mendapatkan keseruan dalam permainan sendiri.

Banyak PNS Cengeng, Daerah Ini Berlakukan Moratorium Mutasi Sevilla Vs Real Madrid: Live Streaming & TV, Prediksi, Susunan Pemain Dan Kabar Terkini | Goal.com Indonesia olympusgratis Bertemu Menpora, Ketua Umum PSSI Sampaikan Beberapa Hal | Goal.com Indonesia Polri Tangkap 19 Tersangka Biang Kerok Solar Langka! Messi Nonton Coldplay di Barcelona, Tak Hadiri Acara Penghargaan Liga Perancis Rasa Bangga Disampaikan Capaska 2021 Setelah Menjalani Latihan Gabungan Paspampres, TNI, dan Polri depo25bonus25 Kronologi Irak Chaos karena Ulama hingga 15 Tewas Ditembak Hadapi Banjir, Kepala BNPB: Perlu Ketegasan Pemimpin Daerah Geger Pembangunan 'Ka'bah Baru' di Jantung Ibu Kota Riyadh how auto insurance is in vallejo PREVIEW Piala Indonesia 2018: Persib Bandung - Borneo FC | Goal.com Indonesia Tarif Tol Tangerang-Merak Naik 12 Februari 2020, Ini Harganya Sambil Menangis & Lap Ingus, Lionel Messi Berpidato Terakhir Di Barcelona | Goal.com Indonesia

Dasar Dalam Permainan Daring

Akun permainan

Anda harus mempunyai akun permainan dalam situs how auto insurance is in vallejo lebih dulu. Hal ini berkaitan dengan permainan penghasil uang yang tepat. Hanya agen permainan aman saja yang dapat memberikan keuntungan untuk Anda. Penting sekali untuk membuat akun dalam agen permainan yang aman.

Dramatis, 10 Pemain Porto Singkirkan Juventus | Goal.com Indonesia PSSI Masih Belum Dapat Rekomendasi Dari FIFA Untuk Gelar KLB | Goal.com Indonesia slotindobet365 Ini Alasan Arab Saudi Larang Warga ke Indonesia Kiper Persija Jakarta Andritany Ardhiyasa Apresiasi Pengawalan Bonek | Goal.com Indonesia Penyerang Go Ahead Eagles Ragnar Oratmangoen Ajukan Syarat Bela Timnas Indonesia | Goal.com Indonesia 3 Kelemahan Timnas Indonesia U-20 Saat Kalah dari Slovakia lion88slotlogin Pemain Mulai Berdatangan, Persija Jakarta Langsung Lakukan Swab Test | Goal.com Indonesia BERITA TRANSFER: Gagal Rekrut Pemain, Tottenham Hotspur Cetak Sejarah | Goal.com Indonesia Negosiasi Mulus, Selangkah lagi Bek Real Madrid Raphael Varane Gabung Manchester United | Goal.com Indonesia how auto insurance is in vallejo Kuat Lalui Tahun Brutal 2022, Ekonomi RI 2023 Masih Andal? Terungkap! Demokrat Maksa AHY Jadi Cawapresnya Anies BERITA MANCHESTER UNITED - Tahith Chong: Ole Gunnar Solskjaer Brilian! | Goal.com Indonesia

Modal bermain

Anda perlu hal lainnya dalam permainan berupa modal. Penting sekali halnya untuk taruhan dengan biaya yang cukup.shio kambing 2 login Anda harus melakukan langkah yang tepat dalam permainan dengan biaya untuk taruhan sepenuhnya.

Kota Bandung PPKM Level 1, Pemkot Bandung Kaji Relaksasi Penonton Pial KABUPATEN SIJUNJUNG INGIN TIRU KOTA BANDUNG dewi188 Suporter Meninggal Jadi Hari Terburuk Stefano Cugurra | Goal.com Indonesia Sri Mulyani Minta Tolong Mahfud, Sabet Anak Buahnya 20 Klub Eropa Paling Efektif Di Depan Gawang | Goal.com Liga 2 2019: PSMS Medan Siapkan Mamadou Diallo Untuk Lawan Persibat Batang | Goal.com Indonesia akunkambojapro PPP Sebut Aspirasi Deklarasi Capres Sandiaga di Gorontalo Tak Dilarang Ekspresi Kecewa Shin Tae Yong Usai Kambuaya Tak Oper Spasojevic GALERI: Daftar Gaji Pelatih Di Euro 2016 | Goal.com how auto insurance is in vallejo Ini Jurus PLN Bisa Garap Proyek Ribuan Triliun Energi Hijau Berita & Hasil Mexico U23 | Goal.com M Rahmat Senang Puasa Bersama Keluarga Di Makassar | Goal.com Indonesia

Mengenal dunia judi

Mustahil halnya Anda mendapatkan keuntungan dalam permainan tanpa adanya pemahaman akan permainan judi sendiri. Anda harus mengenal permainan ini lebih dulu untuk akses yang lebih mudah. Penting melakukan pemilihan pada permainan yang tepat. Anda tidak akan bermain dengan tepat tanpa mempunyai pengalaman dalam dunia permainan judi sendiri.

Daya 450 VA Mustahil Pakai Kompor Listrik, Begini Siasatnya.. Lapor Pak Jokowi! RI Kena Jegal Eropa Lagi, Sawit & Kopi Kena playslot88login David Alaba Tegaskan Komitmen Untuk Bayern Munich | Goal.com Indonesia Lili Shalihat Resmi Dikukuhkan Jadi Ketua Pokja Kelurahan Sehat Depok Nyerah! Polandia & Jerman Akhirnya Minta Minyak Rusia EDITORIAL & LIPUTAN KHUSUS Berita, Halaman 1 dari 20 | Goal.com Indonesia linkslotgratis Takehiro Tomiyasu Akhiri Musim Lebih Cepat, Ada Implikasi Besar Bagi Ben White | Goal.com Indonesia Zinedine Zidane: Cristiano Ronaldo Sulit Digambarkan Dengan Kata | Goal.com Indonesia Siap-Siap, Jokowi Minta Setoran Taipan Batu Bara Lebih Gede! how auto insurance is in vallejo Jokowi Mau Kemiskinan Ekstrem RI Nol di 2024, Yakin Bisa Pak? Alasan Mitra Kukar Pilih Rahmad Darmawan Jadi Pelatih Baru | Goal.com Indonesia Covid-19 Rusia Menggila, Mengular Antrean Ambulans di RS

Beberapa hal ini penting dalam dunia permainan how auto insurance is in vallejo. Menangkan permainan tanpa perlu repot sama sekali. Anda dapat melakukan cara yang sederhana untuk mendapatkan keuntungan besar.juragan 96 login Situs permainan yang tepat harus Anda gunakan untuk keuntungan yang besar dalam dunia permainan daring. Gunakan cara tepat untuk beragam keuntungan dalam dunia permainan.

Rusia & Ukraina Mendadak 'Akur', Ada Apa? Carlton Cole Sudah Pasrah Soal Nasibnya | Goal.com Indonesia wayang888slot Alvaro Odriozola Akan Balik Ke Real Madrid | Goal.com Indonesia Diogo Jota: Saya Latih Telford United Di Gim Football Manager | Goal.com Indonesia Menpora Amali Tekankan Pentingnya Kolaborasi untuk Sukseskan DBON AS Roma Menang Terus Tanpa Jose Mourinho, Kini Sang Pelatih Ogah Dampingi Tim Di Bench | Goal.com Indonesia pangeran86slot 2 Wilayah Ini Sumbang Kasus PPLN Positif Covid-19 Terbanyak Caio Henrique Dikaitkan Dengan Paris Saint-Germain & Barcelona | Goal.com Indonesia Piala Dunia Wanita 2019 - Italia vs Belanda | Goal.com Indonesia how auto insurance is in vallejo Berita Real Madrid v Barcelona, 06/11/22, Primera División Femenina | Goal.com Berita Liverpool - Bantai Cardiff City, Jurgen Klopp Semringah | Goal.com Indonesia Arthur Irawan Ikut Seleksi Di Persebaya Surabaya | Goal.com Indonesia

how auto insurance is in vallejo Situs Judi Poker Domino QQ Terpercaya

how auto insurance is in vallejo merupakan daftar bandar toto togel online terpercaya yang menyediakan permainan situs how auto insurance is in vallejo gacor hari ini deposit via pulsa..

Permainan yang disediakan how auto insurance is in vallejo adalah Bandarq, Poker Online, Bandar Poker, Bandar Sakong, Bandar66, Capsa Susun, Perang Baccarat, AduQ dan DominoQQ Online.

Melihat Blok M Mall yang Sepi Bagaikan 'Kuburan' Kisah Matthew Briggs: Dari Pemain Termuda Liga Primer Inggris Hingga Sekarang Jadi Buruh Bangunan | Goal.com Indonesia akundemoslotbonanzaxmas Transfer Ke Arsenal, Bos Brighton De Zerbi: Caicedo Dipengaruhi Orang Lain! | Goal.com Indonesia Cedera Alberto Moreno Jarang Terjadi | Goal.com Indonesia Baru 28 Menit Kembali Dari Pensiun, Arjen Robben Cedera & Groningen Kalah | Goal.com Indonesia Kota Depok Akan Gunakan Data Disdukcapil untuk Pendataan Vaksinasi Covid-19 bandarsbototo Penampakan Cuaca Bak 'Neraka' di Eropa akibat Gelombang Panas Mal Central Park Dijual Rp 4,5 Triliun Berita Inggris U-21 v Türkiye U21, 13/10/20, Kejuaraan U-21 UEFA | Goal.com how auto insurance is in vallejo Christian Fuchs: Manchester City Atau Liverpool Juara? Saya Tak Peduli | Goal.com Indonesia Berita Persikabo 1973 v Persela, 16/12/19, Liga 1 | Goal.com Fakta Di Balik Keberhasilan Liverpool Juara Liga Primer Inggris & Pecah Rekor Duo Manchester - United & City | Goal.com Indonesia

Keunggulan yang Dimiliki Situs how auto insurance is in vallejo

Situs how auto insurance is in vallejo memiliki Keunggulan yang Tentunya Memuaskan Kamu Sebagai Pemain Judi Online.

- Server yang Always On, jarang maintenance.

- Berbagai link login alternatif

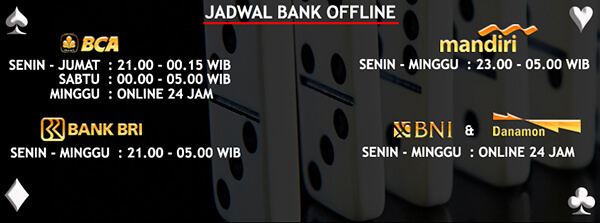

- Berbagai bank alternatif yang disediakan

- Bonus-bonus yang diberikan tentunya menarik

- Akun yang dijamin keamanannya

- Transaksi yang aman dan cepat

- Didukung oleh Customer Service yang ramah dan responsif

- Permainan yang disediakan Sangat Lengkap

Bonus Menarik Dari how auto insurance is in vallejo

Situs how auto insurance is in vallejo memberikan bonus yang menarik untuk semua member yang bergabung. Bonus untuk member baru dan member lama adalah sama. Kamu juga bisa mendapatkan bonus Turnover jika ada bermain. Tentu kamu juga bisa mendapatkan bonus tanpa bermain,link 5000 slot yaitu caranya dengan mengajak temanmu daftar dan bermain dengan kode referral kamu.

5 Pemain Berbahaya Slovakia bagi Indonesia U-20: Ada Teman Witan Jakarta International Stadium - Dipuji Pemain Barcelona & Atletico Madrid, Dikritik Pelatih Timnas Indonesia All Stars | Goal.com Indonesia playbook88.pro Penampakan 'Kota Hantu' Mirip Meikarta di Malaysia Menteri ESDM: Proyek Energi Hijau Harus Transparan Polisi Jaga Ketat Perbatasan Yogya Buntut Bentrok PSHT-Brajamusti Pemain Persib Bandung Kecewa Laga Kontra PSM Makassar Ditunda | Goal.com Indonesia bp0777 LHKPN 2022: Dirjen Pajak Suryo Utomo Punya Utang Rp5 Miliar Laporan pertandingan: Villarreal 1-1 Real Madrid | Goal.com Indonesia Era Tiket Pesawat Mahal Datang, Ada yang Sampai Rp20 Juta how auto insurance is in vallejo Hari Ini, Pasien Sembuh Covid-19 di Depok Tambah 44 Orang Berita Manchester United - Ryan Giggs Tegaskan Tak Akan Ambil Alih Posisi Ole Gunnar Solskjaer | Goal.com Indonesia Menkeu: Pemulihan Ekonomi Dunia Hadapi Tekanan Sangat Berat!

Untuk bonus turnover ini sebesar 0.5% dengan pembagian setiap minggunya. Selain itu, bonus referral sebesar 20% bisa kamu dapatkan seumur hidup. Sangat menarik bukan?

how auto insurance is in vallejo Kompatibel di Semua Perangkat

Kabar baiknya, Kamu bisa memainkan semua game pilihan kamu di situs how auto insurance is in vallejo ini dengan berbagai jenis perangkat seperti Android, iOS, Windows Mobile, Windows PC, Mac OS. Sehingga kamu bisa memaikan game ini dimanapun dan kapanpun saja.

Argentina Juara Piala Dunia, Putin Beri Selamat ke Messi Cs Juan Mata: Ini Terasa Seperti Kekalahan | Goal.com Indonesia toke88 Kemarahan Jokowi dan Kesiapan Hilirisasi Tambang Dalam Negeri Berita Real Madrid v Barcelona, 06/11/22, Primera División Femenina | Goal.com Harga 'LPG' Batu Bara RI Gak Bisa Sama Kaya di China, Kenapa? Diterpa Badai Cedera Usai Jeda Internasional, Xavi Hernandez: Ini Waktunya Barcelona Buktikan Kedalaman Skuad | Goal.com Indonesia rajaslotasia Berita Arsenal FC v Bayern Munich, 18/07/19, International Champions Cup | Goal.com Striker Timnas Indonesia U-19 Ingin Jaga Momentum | Goal.com Indonesia Marco Reus - Kisah Perjalanan Ikon BVB Menjadi Legenda Klub Seperti Michael Zorc | Goal.com Indonesia how auto insurance is in vallejo Brasil Jadi Tuan Rumah Copa America 2021 Setelah Batal Dihelat Di Kolombia Dan Argentina | Goal.com Indonesia Berita Persipura v Bhayangkara, 12/05/17, Liga 1 | Goal.com Susunan Tim Terbaik La Liga Spanyol 2015/16 Jornada 3 | Goal.com